Editor’s note: I recently heard that some D.C brainiacks who want to improve our tax system to be the best for all are considering a consumption tax. I say that it is exactly the wrong system as I explained in this artilce I wrote in 2020. Due to time constraints in my personal life today, I have no time to update this article but I believe it still stands correct. Please read the entire article for great information.

WHY THE SINGLE RATE FLAT TAX IS THE ABSOLUTE FAIREST!

Facts are stubborn things, and whatever may be our wishes, our inclinations, or the dictates of our passions, they cannot alter the state of facts and evidence. – John Adams

By Rich Loudenback

THE WAY IT IS:

Carly Fiorina said on a Fox News Sunday interview during her campaign in 2015 that “The complexity of our government’s 73,000 page tax code favors the big, the powerful, the wealthy, and the well connected. It’s called crony capitalism. Republicans have engaged in it as well as Democrats. The reason it never gets reformed is because everybody’s ox is going to get gored. Every politician, every lobbyists, every accountant, every lawyer. If you level the playing field by simplifying the tax code then you help the small, the powerless and the middleclass.” Mrs. Fiorina said that her fundamental design philosophy is to lower every rate and close every loophole.

WHAT I CALL THE ‘FAIREST TAX’ SHOULD NOT BE CONFUSED WITH THE FAIR TAX.

The word fair when used in the ‘Fair Tax’ is truly an autoantonym or a contronym, i.e. the exact opposite of the meaning you would expect for the word fair. Why? It is really very simple when you actually think about it.

In a Fair Tax, also called a ‘Consumption Tax’ system, poor and middle class people will continue having to ‘spend’ all or most of their incomes for necessities to get by paying consumption taxes in doing so. The same consumption taxes for necessities spent by the better off to extremely wealthy would represent a very disproportionately low percentage of their overall income going to taxes, all the rest of their money being tax free for investments. Sweet.

So if you are better off to extremely wealthy, naturally seeking the least percentage of your income going to taxes, and really don’t give a hoot about ‘fairness’ or your fellow man’s possible plight, this so-called ‘fair’ tax is your kind of deal.

THE FAIR TAX PITCH

The pitch for a fair tax is that it would become our one and only means of taxation. Because it would replace all other taxes as well as replacing the much hated exemptions that enrich the wealthy and most unfairly allows crony mega sized international companies such as, for instance, GE with a net income of $278 million dollars in 2014 paying no taxes at all along with 19 other S&P 500 companies that year. In fact, some profitable companies have even received credits from time to time.

Quoting Matt Krantz in his CNBC.com article back then ’20 Big Profitable US Companies Paid No Taxes,’ “The biggest example during the second quarter is drug making giant Merck. The company had a negative effective tax rate during the second quarter of 7.5%, meaning it actually got a net tax credit. That’s despite the fact that income before taxes at Merck soared 52% to $1.9 billion during the quarter.“

That was before President Trump, and although companies are more profitable now, they are still milking the system as usual legally.

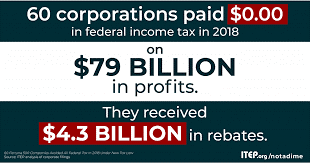

The Institute on Taxation and Economic Policy (ITEP) reports: “An in-depth analysis of Fortune 500 companies’ financial filings finds that at least 60 of the nation’s biggest corporations didn’t pay a dime in federal income taxes in 2018 on a collective $79 billion in profits.

The Institute on Taxation and Economic Policy (ITEP) reports: “An in-depth analysis of Fortune 500 companies’ financial filings finds that at least 60 of the nation’s biggest corporations didn’t pay a dime in federal income taxes in 2018 on a collective $79 billion in profits.

“If these companies paid the statutory 21 percent federal tax rate, they would owe $16.4 billion in federal income taxes. Instead, they collectively received $4.3 billion in rebates. The analysis, ‘Corporate Tax Avoidance Remains Rampant under New Tax Law, examines 2018 corporate financial filings that have been released to date. It provides an initial, comprehensive look at how corporate tax cuts under the 2017 Tax Cuts and Jobs Act affected the tax-paying habits of corporations.

“For years, corporations have manipulated the system to avoid paying taxes, and it’s clear that the 2017 tax law did nothing to change this,” said Matthew Gardner, a senior fellow at ITEP and lead author of the report.”

This is the kind of stuff Socialist Sanders rants about to light up our youth. It also rabidly ticks off every other tax payer in America.

So the promoters of the Fair Tax launch into an enumeration of what is rightfully to be criticized and damned: ‘Democrats never met a tax they didn’t like‘ and everything you ever heard of in tax escaping loopholes and more. After their proper set-up of generating all that bad taste in your mouth, the simple presentation of a one and only consumption (sales) tax replacing everything else sounds beyond palatable to sounding absolutely delicious. ‘Simplicity’…. just for us in La La Land. However, to realists, it actually should be recognized as pure deception. It literally squeezes lower income tax payers and is a dream come true for the wealthy.

PERCENTAGES

Perhaps the most important aspect of the financial world has most to do with the word Percentages. Not dollars.

To my point about percentages, one of my heroes, Thomas Sowell, in his book ‘The Vision of the Anointed,’ states: “As for “the rich,” even if we accept the popular definition of them as people currently above some given income level, those in the top income brackets paid larger sums of money after the Reagan tax rate cuts than before. They even paid a higher percentage of all the taxes paid in the country, according to a report of the House Ways and Means Committee, controlled by Democrats. What bothered the liberals was that “the rich” paid a smaller percentage of their rising incomes than before. But whatever the metaphysics of “fairness,” revisionist history can be checked against hard data – and it fails that test.”

To my point about percentages, one of my heroes, Thomas Sowell, in his book ‘The Vision of the Anointed,’ states: “As for “the rich,” even if we accept the popular definition of them as people currently above some given income level, those in the top income brackets paid larger sums of money after the Reagan tax rate cuts than before. They even paid a higher percentage of all the taxes paid in the country, according to a report of the House Ways and Means Committee, controlled by Democrats. What bothered the liberals was that “the rich” paid a smaller percentage of their rising incomes than before. But whatever the metaphysics of “fairness,” revisionist history can be checked against hard data – and it fails that test.”

COMPLEXITIES AND MANIPULATION

The reason we need a single rate tax is to eliminate the seeds of manipulation by both politicians and tax payers which has sprouted and produced the horrendous growth of our tax system. Our successful capitalist system, watered by the hunger of freedom’s opportunities is handicapped by the many financial machinations of powerful politicians constantly contriving heartfelt expressed reasons to subsidize, micro-manage markets, manipulate money, create crony schemes, contrive complex programs with nefarious agendas, guarantees and minimum wages, with no end to legal plunder. This ability by Congress to establish manipulation must end if we are to ever right our ship back to a totally free market system based on our wonderful Constitution. Also, matters run most smoothly when they run most simply.

The reason we need a single rate tax is to eliminate the seeds of manipulation by both politicians and tax payers which has sprouted and produced the horrendous growth of our tax system. Our successful capitalist system, watered by the hunger of freedom’s opportunities is handicapped by the many financial machinations of powerful politicians constantly contriving heartfelt expressed reasons to subsidize, micro-manage markets, manipulate money, create crony schemes, contrive complex programs with nefarious agendas, guarantees and minimum wages, with no end to legal plunder. This ability by Congress to establish manipulation must end if we are to ever right our ship back to a totally free market system based on our wonderful Constitution. Also, matters run most smoothly when they run most simply.

The ‘good news’ pitch from the proponents of the fair tax is that it supposedly replaces all the other taxes like Gasoline, Inheritance, Cigarette, Insurance Premium, Alcoholic Beverage, Luxury, Blueberry (believe it or not), CDL License, Compressed Natural Gas, Ammunition, Aircraft Jet Fuel, Aircraft Excise, Medicare, and the list seems endless. Ok? However, most of them should be deemed consumption items. Pretty slick, right?

THE SINGLE RATE FLAT INCOME TAX – REAL FAIRNESS

I am a big fan of what I consider to be absolutely the fairest tax there could be. In a fairest world, a single rate, flat income tax with no deductions, no exemptions, and sorry, not even non-profits get exemptions, PERIOD! This may sound at a glance really tough on poor people, but keep in mind they no longer are paying any sales (consumption) taxes on anything. Everybody pays this ‘one and only’ tax and pays the same percentage, eliminating manipulation to lower levels, because after all everyone benefits from what those taxes should be used for. The operative word there is the word ‘should.’ Our government should not be spending on what is not enumerated for in our Constitution.

Under a flat, single rate income tax billionaires definitely pay more dollars in taxes because their effective rate is the same as everyone else’s. They should be grateful for paying more since their corporate freedom in our capitalist system enabled them to earn what they did.

Also, even those on Social Security should be grateful since they will no longer be paying all the other taxes they have! Everyone, no matter how little they make, should pay their ‘fairest’ share since they benefit directly and indirectly from their taxes’ used by the government. It would truly become a time when all Americans could be proud that we would all be paying the same ‘fairest share’ of taxes worthy of flag waving celebration.

America should be all about the states, their rights, and their budgets without control and spending from the federal government! Most of what has gone in our national government has been directed by the nefarious ‘Deep State’ leaders at the globalist Council on Foreign Relations. See: The Council on Foreign Relations: the Deep State’s Leaders ‘In their Own Words’

Reportedly, a Tennessee farmer named Horatio Bunce schooled the legendary David ‘Davey’ Crockett when Crockett was serving as a U.S. Representative, during a chance meeting, “The power of collecting and disbursing money at pleasure is the most dangerous power that can be entrusted to man. The people have delegated to Congress, by the Constitution, the power to do certain things. To do these, it is authorized to collect and pay moneys, and for nothing else. Everything beyond this is usurpation, and a violation of the Constitution.” – Read Article I, Section 8 of our U.S. Constitution. See: Ponder This!

FACTUAL TESTIMONIALS FOR THE SINGLE RATE FLAT INCOME TAX

20 mostly Baltic nations, including Russia, after the breakup of the former Soviet Union all went to the Flat Tax system with great enthusiasm originally and I remember reading that poor people liked paying their fair share and liked particularly that they were paying the same percentage as millionaires. The success of these nations various rates has had mixed results since 1981, most largely because politics once again interceded into the original concepts, subsequently some countries today are adding additional taxes on their way to going backwards. See Countries or Jurisdictions with a Flat Tax as of March 2015. Also see a short statement from Financial Samurai.com, an investment business with a serious challenge called: ‘We’re Ignorant Idiots! Please Tell Us Why A Flat Tax Is Not Fair.’

Quoting Daniel J. Mitchell, Ph.D., a former McKenna Senior Fellow in Political Economy in an article he wrote for the Heritage Foundation in 2006 titled ‘Flat Tax is the Way of the Future:’

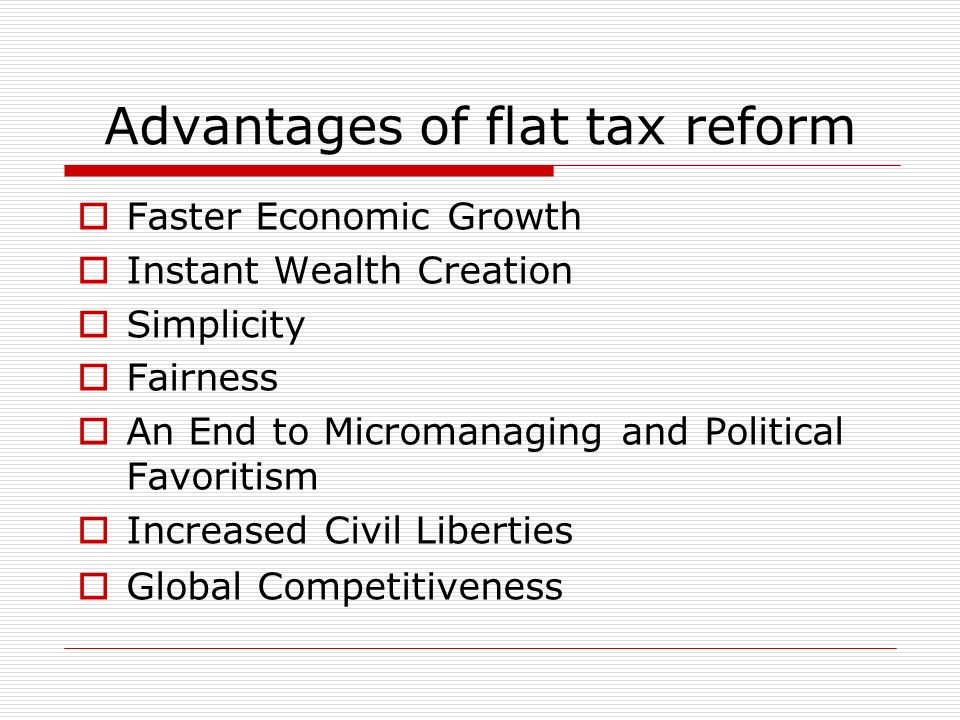

“If enacted, a flat tax would yield major benefits, including:

- Faster economic growth. A flat tax would spur increased work, saving and investment.

- By increasing incentives to engage in productive economic behavior, it would also boost the economy’s long-term growth rate.

- Instant wealth creation. All income-producing assets would rise in value since the flat tax would increase the after-tax stream of income that they generate.

- Simplicity. Complexity is a hidden tax that requires record-keeping, form preparation, lawyers, accountants and other resources to comply with the current system.

- Fairness. A flat tax would treat people equally. A wealthy taxpayer with 1,000 times the taxable income of another taxpayer would pay 1,000 times more in taxes.

- No longer would the tax code penalize success and discriminate against citizens on the basis of income.

- An end to micromanaging and political favoritism. A flat tax gets rid of all deductions, loopholes, credits and exemptions.

- Politicians would lose all ability to pick winners and losers, reward friends and punish enemies, and use the tax code to impose their values on the economy.

- Increased civil liberties. A flat tax would eliminate almost all sources of conflict between taxpayers and the government.

- Moreover, infringements on freedom and privacy would fall dramatically, since the government would no longer need to know the intimate details of each taxpayer’s financial assets.

- Global competitiveness. In a remarkable development, former communist nations are leading a global tax reform revolution. Estonia was the first to adopt a flat tax, implementing a 26 per cent rate in 1994, just a few years after the collapse of the Soviet Union. The other two Baltic republics of the former Soviet Union enacted flat taxes in the mid-1990s, with Latvia choosing a 25 per cent rate and Lithuania picking 33 per cent. Along with other free-market reforms, the flat tax significantly improved economic growth, and the ‘Baltic Tigers’ became role models for the region. Learning from its neighbors, Russia stunned the world by adopting a 13 per cent flat tax, which went into effect in 2001.

- The Russian flat tax quickly yielded positive results: the economy prospered and revenues poured into government coffers since tax evasion and avoidance became much less profitable. The flat tax then spread to Serbia, which in 2003 chose a 14 per cent rate. Slovakia hopped on the bandwagon the following year with a 19 per cent flat tax, as did Ukraine, which chose a 13 per cent rate. Earlier this year, Romania joined the flat tax revolution with a 16 per cent tax rate, and Georgia adopted a 12 per cent rate. This year, Kyrgyzstan adopted a 10 per cent flat tax, giving it the honor, at least temporarily, of having the lowest rate in the world.

- The flat tax revolution has been so successful that Estonia is lowering its rate to keep pace with other nations: it is now down to 24 per cent and will drop to 20 per cent by 2007.Lithuania is in the process of lowering its 33 per cent flat tax to a more reasonable 24 per cent, and the Latvian government wants to reduce its tax rate from 25 per cent to 15 per cent.

- Lawmakers in Croatia, Slovenia, Bulgaria and Hungary are also considering tax reform. Last but not least, the opposition parties in the Czech Republic have promised to implement a 15 per cent flat tax regime if they win the upcoming elections.

- No discussion of the flat tax is complete without a mention of Hong Kong. After World War II, Hong Kong was one of the poorest places on the planet. But a flat tax was adopted in 1947, and this system – combined with other free-market policies – led to dramatic increases in economic performance. Today, Hong Kong’s optional flat tax (taxpayers can choose to participate in a so-called progressive scheme) should serve as a role model for other jurisdictions.

- Traditional income tax systems punish the economy, impose heavy compliance costs on taxpayers, reward special interests and make a nation less competitive. A flat tax would dramatically reduce these ill effects.

- More importantly, it would reduce government power over the lives of taxpayers and get it out of the business of trying to micromanage the economy.

- There will never be a tax that is good for the economy. But the flat tax moves the system much closer to where it should be – raising the revenues that government demands, but in the least destructive and least intrusive way possible.” – Unquote Daniel J. Mitchell, Ph.D.

Why shouldn’t Warren Buffet be paying the same effective tax rate as his secretary? Instead, he’s paying a lower tax rate.

TARIFF’S

For those originalists who believe we should be able to do it all with Tariffs, Steve Byas in his article ‘Are Tariffs Good for America?’ pretty well covers it all in the following quote from that article: “Tariffs were the main source of revenue for the federal government until the passage of the federal income tax in 1913. Of course, that was before the creation of the modern welfare state and the modern military establishment, so the government’s activities at the time were much more limited, and the tariff was quite adequate to meet its revenue needs.”

For those originalists who believe we should be able to do it all with Tariffs, Steve Byas in his article ‘Are Tariffs Good for America?’ pretty well covers it all in the following quote from that article: “Tariffs were the main source of revenue for the federal government until the passage of the federal income tax in 1913. Of course, that was before the creation of the modern welfare state and the modern military establishment, so the government’s activities at the time were much more limited, and the tariff was quite adequate to meet its revenue needs.”

Tariffs remain one of our most effective trade negotiation tools which President Trump has recently proven.

OUR NEED FOR ENLIGHTENMENT

I believe that caring Americans would enthusiastically get behind the right effort once they understand the facts and means to an end. The problem is, how we inform them, with our propagandist media doing all they can to not support such endeavors while actually “denying liberal bias, brushing off viewers and painting their detractors as wild-eyed ideologues?” – As Bernard Goldberg states in his book ‘Arrogance, Rescuing America from the Media Elite.

Monumental understanding and courage needs to find pathways to Americans’ hearts where their noble insights and motives can reign again. Citizens need to awaken to the need to study the Constitution, the issues, inform others and cull and replace violators to our Constitution with real patriots. Then through congressional action and NULLIFICATION by the states eliminate whole Un-Constitutional bureaucracies, agencies and millions of overpaid unnecessary government workers. President Trump has performed an amazing start at this but much more needs being accomplished.

Monumental understanding and courage needs to find pathways to Americans’ hearts where their noble insights and motives can reign again. Citizens need to awaken to the need to study the Constitution, the issues, inform others and cull and replace violators to our Constitution with real patriots. Then through congressional action and NULLIFICATION by the states eliminate whole Un-Constitutional bureaucracies, agencies and millions of overpaid unnecessary government workers. President Trump has performed an amazing start at this but much more needs being accomplished.

As most people have heard before, the main problem with undergoing these drastic changes is that nobody wants their ox gored. While draining the swamp we need to simultaneously open season on Ox Goring. It’s not impossible and can be accomplished with enough foresight and conviction to accomplish this most righteous goal. Remember, our nation accomplished the tremendous goal of putting a man on the moon under the great pressure of a timeline that most people thought impossible.

The urgent importance for our dire need to get back to our Constitution is not folly but fact. If we continue down this road of regulative socialism, insane runaway spending that drives the manipulative taxation and, financial treachery by the Federal Reserve, believe it or not, we will surely fail just like the Roman Empire, as sure as all businesses have to close their doors when profitability is gone. It can and will happen because accountability reigns.

Or, we can smell the coffee, listen to President Trump and help him right our ship. This is not a party thing. It is a Constitution thing, and to that end we must pray that President Trump will learn the Constitution better and fire trusted advisors who are really deep state liars.

Once again, I must state that I believe the most heinous of crimes is the violation of the public trust and the violation to the sacred oath to our Constitution that all elected officials make.

WHAT WE MUST DO!

There’s a very simple way of identifying which elected representatives need replacing in Congress in Washington, D.C. and our Idaho statehouse. The Freedom Indexes for both bodies which show exactly how they vote with criteria in keeping with our US Constitution and Idaho’s State Constitution and then cull them at the voting box.

For the U.S. Congress see “The Freedom Index” at thenewamerican.com/freedom-index/ is a Congressional Scorecard Based on the U.S. Constitution” rates congressmen based on their adherence to constitutional principles of limited government, fiscal responsibility, national sovereignty, and a traditional foreign policy of avoiding foreign entanglements. In the two year, 116th Congress just completed this January, here is how abysmally our congressmen and senators in Washington, D.C. voted with the Constitution: U.S. House 36% and U.S. Senate 28%. So there you see now why we are where we are.

The Idaho Freedom Index for the state is published by IdahoFreedomIndex.com.

Don’t count on a thing politicians say, only believe what you see and judge them on how they vote!

The terrible voting records revealed in the two The Freedom Indexes, is exactly the explanation for why we are rapidly becoming a socialistic society and our Republic is in danger of evolving into losing our national sovereignty and becoming first a member state of a regional government like a North American Union which the recently signed USMCA is designed to take us to, which will be overseen by the corrupt UN, and then on to a world government also run by unaccountable, unelected global power elitists who know what’s best for us about everything. Goodbye to America’s sovereignty and our beloved freedoms. See: CFR Pres. Richard Haas: “USMCA is NAFTA plus TPP plus a few tweaks.” – AND, Trump Hasn’t a Clue! and What’s Really in the USMCA? – A MUST READ!!!

AMERICA MUST BE RESTORED

President Trump has accomplished much toward making America great again, with his executive orders eliminating regulations, building the wall and much, much more. Although, President Trump needs help getting more familiarized with the Constitution and learning that he recognize that some trusted advisors are lying to him. He gets it way better than most Americans, many of whom are apathetically relying on the propaganda of the fake news big media and don’t yet have a clue.

President Trump has accomplished much toward making America great again, with his executive orders eliminating regulations, building the wall and much, much more. Although, President Trump needs help getting more familiarized with the Constitution and learning that he recognize that some trusted advisors are lying to him. He gets it way better than most Americans, many of whom are apathetically relying on the propaganda of the fake news big media and don’t yet have a clue.

To restore America back in line with the original tenets of our Constitution we must first accept one absolute fact. Socialism, (government control) fails and freedom succeeds. Simple as that.

The late, not so great Soviet Union’s socialist citizens experienced a life of guarantees for all the necessities of life, meager as it was: Education, Home (make that apartment,) Job, Medical Care & Retirement. Literally everything was decided on and taken care of by government. Missing, however, was one basic ingredient to make it all work.

Work. Work that would have provided the money that would have come from taxes had Government Controls not squashed the environment for entrepreneurs and investors to thrive. Government magic was an illusion.

What has made America run is vibrant business in the free marketplace of a capitalist system. Productivity and its subsequent profit are absolutely necessary for our success as a nation.

True freedom is pure capitalism. Capitalism is the freedom to win at starting a business or investment and cannot and must not provide ‘subsidized’ guarantees for those that attain less. Failure is a lesson learned well and one moves on, strengthened from the experience. One can strive to achieve all he wants or adjust to what levels of accomplishment he attains. Businesses accountably making a profit, subsequently creating commerce and providing jobs are the root sources of all governments’ funding. A growing economy that creates more tax paying employees will bring in more revenue than higher tax rates and new taxes which conversely hurt us. President Trump has much more very hard work to do in getting a Congress that will work with him toward completing these ends. Executive orders are too easily changed by future administrations. We need many existing un-Constitutional laws eliminated by Congress.

‘THE LAW’

Quoting Frederic Bastiat from his book ‘The Law’: “Legal plunder can be committed in an infinite number of ways. Thus we have an infinite number of plans for organizing it: tariffs, protection, benefits, subsidies, encouragements, progressive taxation, public schools, guaranteed jobs, guaranteed profits, minimum wages, a right to relief, a right to the tools of labor, free credit, and so on, and so on. All these plans as a whole — with their common aim of legal plunder — constitute socialism.

Quoting Frederic Bastiat from his book ‘The Law’: “Legal plunder can be committed in an infinite number of ways. Thus we have an infinite number of plans for organizing it: tariffs, protection, benefits, subsidies, encouragements, progressive taxation, public schools, guaranteed jobs, guaranteed profits, minimum wages, a right to relief, a right to the tools of labor, free credit, and so on, and so on. All these plans as a whole — with their common aim of legal plunder — constitute socialism.

“No legal plunder: This is the principle of justice, peace, order, stability, harmony, and logic. Until the day of my death, I shall proclaim this principle with all the force of my lungs (which alas! is all too inadequate).” Try to imagine a regulation of labor imposed by force that is not a violation of liberty; a transfer of wealth imposed by force that is not a violation of property. If you cannot reconcile these contradictions, then you must conclude that the law cannot organize labor and industry without organizing injustice.

“Socialism, like the ancient ideas from which it springs, confuses the distinction between government and society. As a result of this, every time we object to a thing being done by government, the socialists conclude that we object to its being done at all. We disapprove of state education. Then the socialists say that we are opposed to any education. We object to a state religion. Then the socialists say that we want no religion at all. We object to a state-enforced equality. Then they say that we are against equality. And so on, and so on. It is as if the socialists were to accuse us of not wanting persons to eat because we do not want the state to raise grain.

“If the natural tendencies of mankind are so bad that it is not safe to permit people to be free, how is it that the tendencies of these organizers are always good? Do not the legislators and their appointed agents also belong to the human race? Or do they believe that they themselves are made of a finer clay than the rest of mankind?

“It seems to me that this is theoretically right, for whatever the question under discussion — whether religious, philosophical, political, or economic; whether it concerns prosperity, morality, equality, right, justice, progress, responsibility, cooperation, property, labor, trade, capital, wages, taxes, population, finance, or government — at whatever point on the scientific horizon I begin my researches, I invariably reach this one conclusion: The solution to the problems of human relationships is to be found in liberty.” Unquote – Frederic Bastiat