The University of Phoenix Bailout Swindle at U of I

The “Nondisclosure” Agreement

By NI Slow Growth Research

There is so much wrong with the inexplicable bailout of the University of Phoenix by the University of Idaho that it is difficult to know where to begin.

The deal obviously makes no sense for the University of Idaho (UI). Everyone knows the University of Phoenix (UP) has a bad reputation, legal problems and has been in decline for over a decade. Its current owner, Apollo Global Management, has been trying to unload it for two years. Then suddenly, with no warning or disclosure of details, the University of Idaho appears, half-a-billion dollars in hand, raring to purchase a failing University that no one else in the country wants.

The deal was negotiated in secret; serious investigation is blocked by nondisclosure agreements; the purchase price seems absurdly high; and the official explanation for why this deal benefits the University of Idaho is entirely unconvincing. We are provided a vague explanation of how the purchase will be financed and are reassured that “Idaho taxpayers will not be on the hook”, but the numbers do not even begin to add up. This is way beyond fishy.

It is obvious that something is going on behind the scenes. And since we are not being told the full story, it is the purpose of this article to speculate on what a “worst case scenario” for the University of Idaho might be, and who might benefit from it.

The officials who negotiated this dubious deal are very knowledgeable. The current UI President has worked for decades in Global Finance and is an expert at Financial Law. Several members of ISBE are investment managers and the private equity firm that is trying to unload the University of Phoenix was founded by high yield bond traders. These people understand the risks and know what they are committing to.

So if a bunch of much-too-clever people are secretly negotiating a half billion dollar deal for the purchase of a poorly regarded university for many times its actual value, and that deal has a disastrous outcomes for the people of Idaho, it’s not an accident. Someone is benefitting from this.

Liebich’s Letter Defending the Deal

In order to set things straight, Kurt Liebich, President of ISBE, has written a letter claiming that the purchase of UP is a “Good Business Decision” and a “Huge Homerun.” It was written to sooth concerned citizens, but it is mostly handwaving. However, if we skip to page three, the letter explains how the purchase will be financed.

In short, the plan is to create a non-profit corporation, called NewU of which UI is the sole trustee. This non-profit will then absorb the assets of the University of Phoenix and issue $685 Million dollars’ worth of bonds to cover costs. This money will be used as follows:

- $350M will be paid to Apollo Global Management, the current owners of University of Phoenix, and UP will become a wholly owned subsidiary of NewU.

- $200M will be given to NewU as cash reserves, so that it can remain solvent and make all necessary interest payments on the $685M bond for at least 6 to 8 years, while everyone involved with negotiating the deal moves on or retires.

- $135M are “loan fees”. These huge upfront fees are an indication of how risky the financial community believes the bonds really are, and they will disappear into the coffers of the global financial community as soon as the deal is signed.

In summary, the University of Idaho is planning to borrow $685M from high-risk bond traders so that it can buy a company with a poor reputation in an increasingly competitive market for $350M, and then infuse it with $200M in order to stave off bankruptcy while everyone who was responsible for the deal leaves town.

The officials who have negotiated this outrageously lopsided deal are representatives of global finance disguised as public servants, and they are not working in the best Interests of the people of Idaho.

What will happen if NewU Defaults?

The way the deal appears to be structured is that UI, by way of the NewU “non-profit” corporation, will assume liability for the entire loan, and that it expects to receive income of up to $20-$30M per year from the online University in order to cover the cost of the secured, tax-free bonds. To make this whole scheme workable, UI must provide security for the loan, because the interest rate on unsecured bonds would be prohibitive.

But none of this makes any sense. If UP was consistently generating $30M per year in profits, and if it did not have potential liabilities from lawsuits, it would not be on the auction block. And it would not need a $200 million dollar injection of funds from the sale proceeds, or a $25M line of credit from UI to be solvent.

As everyone knows, the world of online education is constantly changing and becoming ever more competitive. UP has already lost a huge portion of its market share and no one is certain what the future will bring. It is not at all unlikely that UP revenues will continue to decline, and that within a few years then entire burden of a half billion dollar in debt will fall on the University of Idaho.

Promoters of the UI-UP merger cite Purdue’s 2017 purchase of Kaplan as a precedence for such a partnership, but they failed to mention that Purdue University received all of Kaplan’s assets for a single dollar, and the deal was still not favorable for Purdue. There is simply no successful precedent whatsoever for what the deal’s advocates are claiming.

The $200M infusion of cash, and additional credit from UI’s “Strategic Initiatives” fund will keep NewU afloat for at least 5-8 years. Then what happens? According to reports, University of Idaho is only committed to pay bondholders $10M per year in case NewU defaults on their payment. But for how long? And what happens to NewU? And will bond holders be able to sue for UI assets? Is Bankruptcy an option?

This is the $600 Million dollar question. Best case scenarios are of little interest. Idaho residents need to know EXACTLY what will happen to the assets of the University of Idaho if the NewU Partnership utterly fails.

This is important because that the University of Idaho has assets of nearly a billion dollars, including around 33,000 highly coveted acres of undeveloped land. And high yield bond traders know that making “risky” loans to institutions with fungible assets can be very profitable. So it is reasonable to assume that in a “worst case scenario” there may be a plan to get their hands on UI assets by forcing NewU into bankruptcy.

From the point of view of sophisticated financiers, bankruptcy can be a boon because it provides a way for special “deals” to be made with creditors that would not be possible under normal conditions. For example, under normal conditions, UI would be unlikely to sell its highly coveted, legacy acreage. But in order to get out from under long term obligations from a catastrophic bond failure, it may be required to do so.

We don’t know if the scenario we’ve outlined above is likely, but we are certain that the global financiers behind the half billion dollar PU bond have a long term “end game” in mind. We just don’t know what it is.

As Liebich assures us in his letter “Yes, there is . . . risk in this bold and innovative transaction.” Please tell us Mr. Liebich, EXACTLY what these “Risks” entail. How will the University of Idaho discharge is obligations to creditors when the precarious NewU “partnership” comes crashing down.

Who is Apollo Global Management?

Now let’s take a closer look at “Apollo Global Management”, the private equity firm that owns the University of Phoenix and approached UI regarding a buyout. A little background may be helpful.

In the 1980s, the Reagan era stock market boom gave rise to an unprecedented rush of leveraged buyouts, high risk securities, and the rise of private equity. Michel Milken, famed Junk bond trader, was a financial baron of the age who reaped enormous rewards by taking on high risk debt from distressed companies. And his phenomenal success was based as much on making sure that his bond holders were first in line in bankruptcy courts when a crisis hit, as it was on the elevated interest rates of “risky” investments.

The reason this is important is that Apollo Global Management was founded by the junk bond trading cronies of Michael Milken, after their company collapsed amid charges of unethical trading. The executive leadership of AGM, therefore, is expertly practiced in the arts of high-risk bond negotiations, and it is certain that they and their cronies will be well-taken care whether NewU succeeds or fails.

And that is not the only reason that the AGM management team appears to be shady. For over thirty years the CEO of AGM was Leon Black, a Michael Milken protege. But two years ago he was forced to resign when his extensive dealings with Jeffrey Epstein were brought to light. It seems that UI picked an extraordinarily sketchy group of global financiers to dump half a Billion dollars on. No wonder all negotiations were done under strict nondisclosure.

You can read about how Epstein’s relationship with Apollo’s CEO ended disastrously here.

Who is Negotiating on Behalf of U of I?

Now we should take a closer look at who is representing the citizens of Idaho on the UI side of the bargaining table. Who signed off on this terrible deal? And are they really innocent dupes or are they “in-on-it”. It’s not a difficult call. One clue is this quote in the Idaho Statesman from UI President, Scott Green.

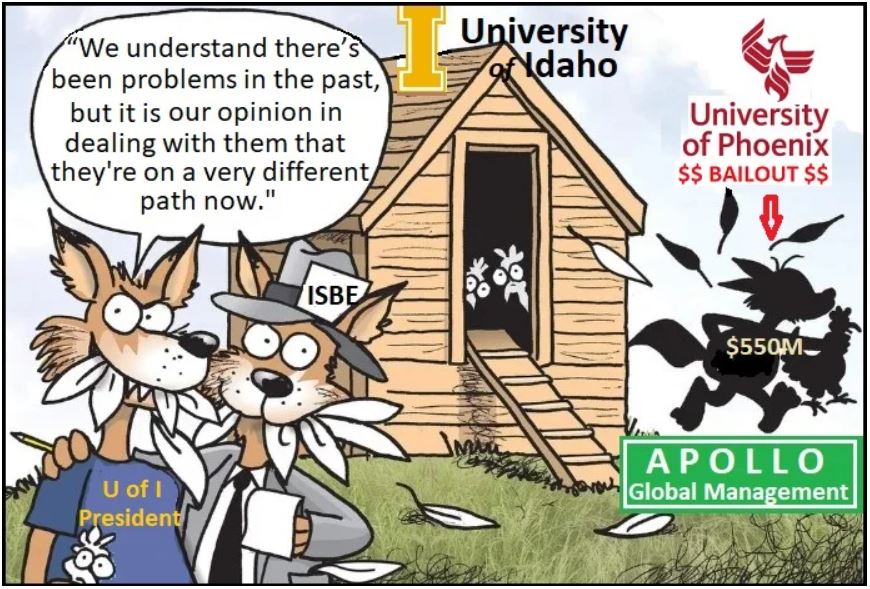

“We understand there’s been problems in the past, and people were rightly upset for past behaviors, but it is our opinion in dealing with them and going through our due diligence that they’re on a very different path now. There is some reputational risk there . . . .but we’re not afraid of it because we are comfortable with who they are, and we know we can help them.”

Did the UI President just say that, in spite of acknowledged ethical problems and institutional risks, he is “comfortable” with these swindlers, and he is prepared to put the University of Idaho half a billion dollars in debt because he “knows he can help them”? For Real? Who is this guy?

Here is a link to UI President Scott Green’s biography on the University of Idaho Website.

It seems Green was appointed president in 2019 and prior to that spent his entire career in global finance and financial law. He worked at Deloitte, Goldman Sachs, and Barings, and he “wrote the book” on the 2002 reform of auditing and financial reporting.

President Green is a big fish in the world of Global Finance, but he has no actual working experience in education or University administration. Why is this? When searching for qualified leadership of its flagship University, why did the Idaho State Board of Education seems to think that connections in the world of Global Finance is the chief qualification for a University President.

So the ultimate responsibility for this fiasco traces back to ISBE who purposely appointed a President whose loyalties were alligned with global finance rather than with the educational mission of the University.

None of this is surprising. NISGR has written about ISBE in previous articles, since it figures prominently in the ongoing NIC drama and in every case ISBE has thrown in its lot with Globalists, Investors, and Crony Capitalists. LIke President Green, ISBE Chairman Liebich is a partner in a global Investment firm and a Gold Star member of the BIG CLUB. No one questions their competence; only their primary loyalties.

The Globalist Fox in the Educational Henhouse

But the problems at IBSE go far beyond Liebich. Only two of the seven appointed members of the state board of education have professional experience in either education or research. All the rest are wealthy investors or politicians with explicitly globalist allegiances. And three of the members, Liebich, Gilbert, and Roach, are board members of the influential lobbying group, “Idaho Business for Education.

Why is this important? Because Idaho Business for Education is an excedingly well connected group of investors who have their tenacles into almost every aspect of Public Education in Idaho, and their intentions are not philanthropic. Unlike ISBE, whose deliberations are subject to FOIA, IBE is a private organization, with exclusive membership, that wields enormous influence from private quarters. The great majority of IBE’s board members are drawn from the Banking and Finance sectors, rather than actual businesses; and if you visit the IBE website you are likely to see some very familiar faces.

Idaho Business for Education, is in fact, a lobbying group for Global Finance, and the Boise Oppenheimers, who founded IBE, are part of a globally interconnected banking family, whose investment holding company is connected with AGM. But that is not as significant as it may seem, these types of private equity holding companies are highly interconnected. Global Finance is a “team sport.”

There is much more to say about Idaho Business for Education and its dubious influence on Education policy in Idaho. But it is clear that the University of Phoenix bailout was initiated, not because it was good for the University of Idaho, but because the Lords of Global Finance,—to whom our governor has handed over complete control of Idaho’s public education system,—favored the partnership.

The Globalist Fox is in the Education Henhouse, and the feasting on public monies and on long established, well-endowed educational institutions will continue until there is nothing left worth pillaging.

From nislowgrow.org