ENVIRONMENTAL, SOCIAL, AND GOVERNANCE (ESG) SCORES

By Heartland Institute staff

LEGISLATORS: Email StopESG@heartland.org to contact our team for help.

LEGISLATIVE POLICY TIP SHEETS

ESG: A Simple Breakdown of its Components

ESG: The Role of the U.S. Securities and Exchange Commission

ESG: The Effects Upon Free Markets

ESG: Primary Architects and Implementers

ESG: Negative Effects on Food Supply and Agriculture

LEARN THE BASICS

Are Financial Institutions Using ESG Social Credit Scores to Coerce Individuals, Small Businesses?

Justin Haskins

Understanding Environmental, Social, and Governance (ESG) Scores, and Why Lawmakers Should Oppose Them

Justin Haskins

Understanding Environmental, Social, and Governance (ESG) Metrics: A Basic Primer

Justin Haskins and Jack McPherrin

ESG Is Not Part of a ‘Free-Market’ Economy. It’s the Result of Corruption, Cronyism, and Big Government

Justin Haskins

What are ESG scores, and why are so many advocates of liberty deeply concerned about them?

KEY TERMS AND ISSUES

Klaus Schwab and a growing list of powerful global economic and political elites, including BlackRock CEO Larry Fink[1] and President Joe Biden,[2] have recently committed to a global “reset” of the prevailing school of economic thought. They seek to supplant the entrenched “shareholder doctrine” of capitalism, which—as Milton Friedman famously espoused over 50 years ago—holds that the only purpose of a corporate executive is to maximize profits on behalf of company shareholders.[3]

To replace shareholder capitalism, Schwab, Fink, Biden, and a legion of their peers have promulgated a nouveau “stakeholder doctrine,” commonly referred to as “stakeholder capitalism.” This approach, which aims to harness the growing clamor for more socially conscious corporate decision-making, authorizes, incentivizes, and even coerces corporate executives and directors to work on behalf of social objectives deemed by elites to be desirable for all corporate stakeholders—including communities, workers, executives, and suppliers.[4]

Environmental, social, and governance (ESG) scores—a social credit framework for sustainability reporting—are being used as the primary mechanism to achieve the shift to a stakeholder model. They measure both financial and non-financial impacts of investments and companies and serve to formally institutionalize corporate social responsibility in global economic infrastructure.[5]

Environment, social, and governance scores are theoretically supposed to incentivize “responsible investing” by “screening out” companies that do not possess high ESG scores while favorably rating those companies and funds that make positive contributions to ESG’s three overarching categories. A company’s ESG score has become a primary component of its risk profile.[6]

Who Are the Agents Responsible for this Shift, and What Have They Done to Bring It About?

Although there have been many ESG frameworks developed over the past decade, in the past three years alone, three major documents and compacts have been signed by a coalition of corporate governors, political elites, central bank directors, international organization representatives, and other powerful individuals. Together, they have had a substantial impact on the global economy and the shift to ESG.

In August 2019, The Business Roundtable (TBR)—comprised of 181 of the most powerful corporate executives in the United States—officially revised its conception of a corporation’s purpose to “promote an economy that serves all Americans.”[7] The companies these CEOs represent hail from nearly all sectors of the U.S. economy, including major financial institutions, media conglomerates, technology firms, defense contractors, pharmaceutical companies, and myriad others. (READ MORE.)

HEARTLAND’S WORK ON ESG

Testimony

Testimony Before the New Hampshire Senate Commerce Committee Regarding HB 1469

Bette Grande, April 12, 2022

Testimony Before the Missouri Senate Small Business and Industry Committee Regarding SB 1171

Bette Grande, March 22, 2022

Testimony Before the Tennessee House Finance, Ways and Means Committee Regarding HB 2672

Bette Grande, March 9, 2022

Testimony Before the Kentucky Senate Natural Resources & Energy Committee Regarding SB205

Bette Grande, March 2, 2022

Testimony Before the Tennessee Senate State and Local Government Committee Regarding SB 2649

Bette Grande, March 1, 2022

Testimony Before the Wyoming Senate Appropriations Committee Regarding SF0108

Bette Grande, February 24, 2022

Testimony Before the Wyoming Senate Appropriations Committee Regarding SF0108 – Supplemental Testimony

Bette Grande, February 24, 2022

Testimony Before the Vermont General Assembly Senate Committee on Government Operations Regarding S.251

Bette Grande, February 22, 2022

Testimony Before the Arizona House Commerce Committee Regarding House Bill 2656 – Supplemental Testimony

Bette Grande, February 15, 2022

Testimony Before the Arizona House Commerce Committee Regarding HB 2656

Bette Grande, February 15, 2022

Testimony Before the Virginia General Assembly Senate Finance & Appropriations Committee Regarding SB 213

Bette Grande, February 10, 2022

Testimony Before the Hawaii House Committee on Energy & Environmental Protection Regarding HB 2278

Tim Benson, February 8, 2022

Bette Grande, February 7, 2022

Testimony Before the Indiana House Financial Institutions and Insurance Committee Regarding HB 1224

James Taylor, January 25, 2022

Testimony Before the Indiana House Financial Institutions and Insurance Committee Regarding HB 1224

Bette Grande, January 22, 2022

Testimony Before the Indiana House Financial Institutions and Insurance Committee Regarding HB 1224 – Supplemental Information

Bette Grande, January 22, 2022

Testimony Before the New Hampshire House Commerce and Consumer Affairs Committee Regarding HB 1469

Bette Grande, January 22, 2022

NEWS AND OP-EDs

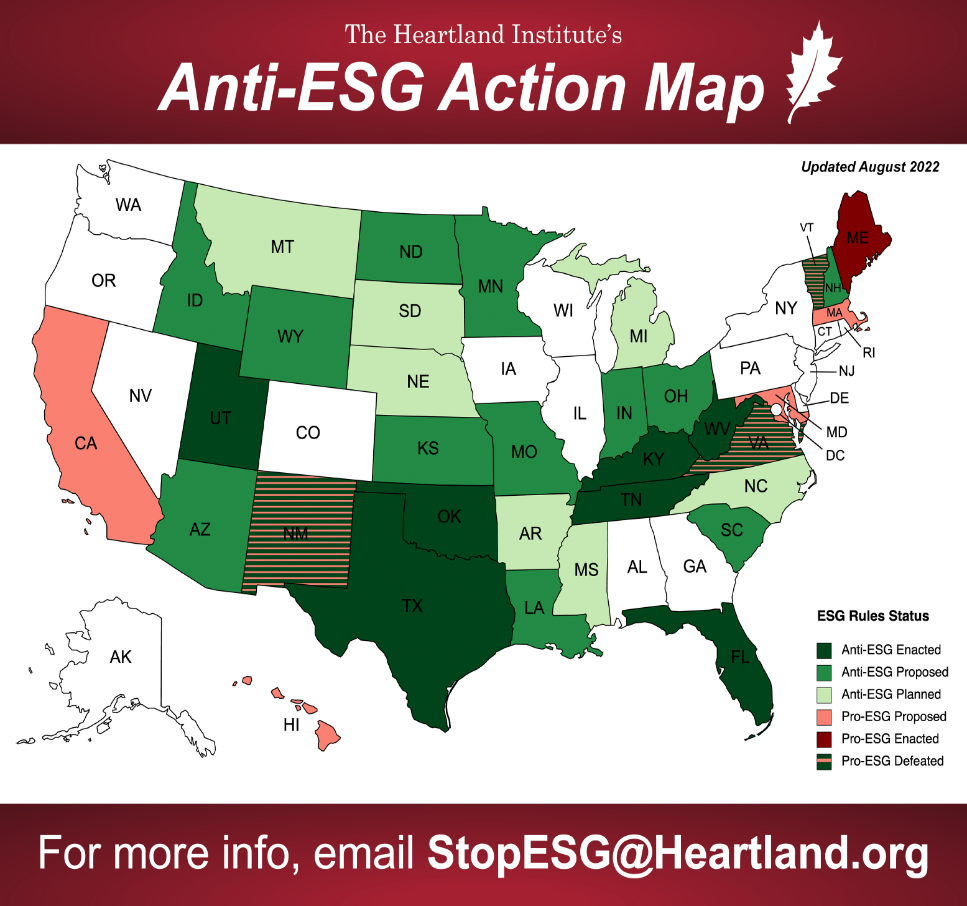

The Fight Against ESG Is Gaining Momentum

Jack McPherrin, Western Journal, August 9. 2022

Gov. DeSantis Declares War on Environmental, Social, and Governance Investing Scam

Chris Talgo, Townhall, July 29, 2022

The White House’s Secret Meetings With BlackRock Are a Major Threat to Freedom

Justin Haskins, RedState, June 28, 2022

Kentucky Attorney General: ESG Investing Is ‘Inconsistent with Kentucky Law’

Chris Talgo, Townhall, May 28, 2022

A Global ESG System Is Almost Here: We Should Be Worried

Jack McPherrin, The Epoch Times, May 31, 2022

ESG Scores Similar to China’s Social Credit System, Designed to Transform Society

Teny Sahakian, Fox Business (featuring Justin Haskins), May 18, 2022

How the ESG Movement Is Shooting Itself in the Foot

Bette Grande, American Thinker, May 12, 2022

ESG Ratings Are Counterproductive, Hypocritical, and Anti-American

Jack McPherrin, Human Events, April 29, 2022

Mastercard: ‘ESG Goals Will Now Factor into Bonus Calculations for All Employees’

Chris Talgo, Townhall, April 26, 2022

The ESG Movement Is Even Worse Than You Think

Bette Grande, Human Events, April 12, 2022

Debunking the Media’s Lies About ESG Social Credit Scores and the Great Reset

Glenn Beck and Justin Haskins, The Blaze, March 30, 2022

The Environmental, Social, and Governance Threat

Bette Grande, Issues & Insights, March 23, 2022

ESG Standards Are Predicated on Cronyism

Bette Grande, RedState, March 15, 2022

What Are ESG Scores?

Jack McPherrin, RedState, March 2, 2022

Why banks are fighting ESG legislation

Bette Grande, American Thinker, February 23, 2022

Public Pension Plans Are the Wrong Place for Public Policy Experiments

Bette Grande, Red State, February 16, 2022

Socialist Squad Members Demand SEC Implement ‘Climate Rule’

Chris Talgo, Stopping Socialism, February 16, 2022

11 things you can do to help stop the Great Reset

Glenn Beck, Justin Haskins, Stopping Socialism, February 1, 2022

Ottawa, Canada is following Germany’s failed climate goals

Ronald Stein, P.E., The Heartland Institute, February 1, 2022

“ESG” = Extreme Shortages Guaranteed!

Ronald Stein, P.E., The Heartland Institute, January 26, 2022

Divesting in Crude Oil Guarantees Shortages and Inflation

Ronald Stein, P.E., The Heartland Institute, December 21, 2021

Conference Warns of Climate Socialism Agenda

Sterling Burnett, The Heartland Institute, October 28, 2022

What Is Wrong With “ESG” Wokeism

Heartland Daily News, October 8, 2021

Report: ESG Funds Are Riskier Than Others

Eileen Griffin, Environment and Climate News, September 28, 2021

Woke Companies Must Wake Up on ESG

Paul Driessen, The Heartland Institute, September 8, 2021

SEC Considering ESG Disclosure Mandates for Advisory Firms

Eileen Griffin, Environment and Climate News, July 28, 2021

House Passes Bill to Mandate ESG Disclosures

Kevin Stone, Environment and Climate News, July 13, 2021

Texas Rejects ESG Investing As Movement Grows

Eileen Griffin, Environment and Climate News, June 28, 2021

How the European Union Could Soon Force America into the ‘Great Reset’ Trap

Justin Haskins, Stopping Socialism, June 22, 2021

VIDEOS

Justin Haskins on Fox Business: ESG Scores Similar to China’s Social Credit System, Designed to Transform Society

An explanation by Heartland’s Justin Haskins of what’s at stake and why it matters.