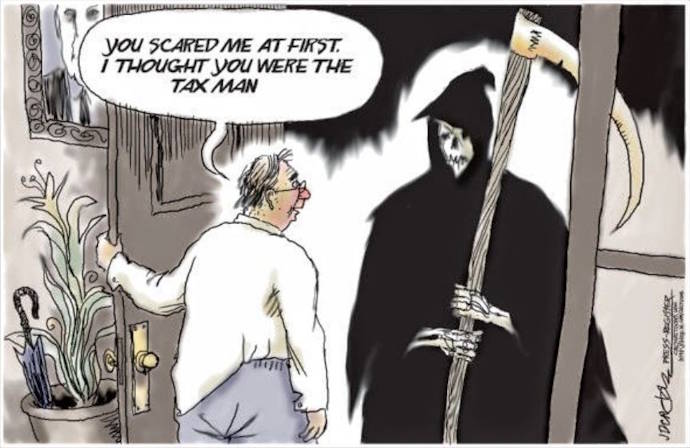

Taxman Cometh

By Brent Regan

“Don’t tax me; don’t tax thee, tax the fellow behind the tree.”

With the election season coming up the subject of taxes, particularly property taxes, is often discussed. Knowing how property taxes are assessed is helpful when evaluating candidates.

Kootenai County has over 240 elected offices with budget authority in 45 taxing entities including the county, 14 municipalities, school districts, highway districts, fire districts, water districts, sewer districts and other specialty districts. Look on your Property Tax Assessment to see all the districts that take a bite out of your wallet.

All these districts don’t directly set your taxes, they set their budgets. This is an important distinction that many, including some elected officials, don’t understand. Here is a high level overview with some detail omitted for clarity.

Property taxes are set and managed at the county level, not at the state level. While Idaho code does not set tax rates, it does set certain limits and exemptions.

The Kootenai County Board of County Commissioners (BOCC), consisting of three elected commissioners, sets the county’s budget and approves levy rates for county-wide services. They also act as the Board of Equalization for property tax assessment appeals. The BOCC approves the county’s budget and coordinates with other taxing districts to ensure compliance with budget limits

Each county district sets its own budget. This is the amount of money the district needs to operate for the year. The state legislature has put in Idaho code limits on how fast a district’s budget can grow year after year. A district’s budget can increase from three factors:

Growth due to new construction and annexation. This growth factor is calculated by multiplying the preliminary levy rate by the value of new construction and 90% of the value of annexations from the previous year. This ensures districts can fund services as areas grow. The tax you pay shouldn’t increase due to budget increases as a result of growth because the taxable properties are also increasing. New houses pay property tax so budgets can grow without impacting you.

Baseline Increase. In addition to growth, the district can take an additional 3% increase. Increases over baseline DO impact your taxes. Think of this as budget “inflation” where you pay more dollars for the same services.

Foregone taxes. If the district doesn’t take a portion of the 3% one year they can take it in subsequent years, but are limited to 1% for ongoing services and 3% for large investments such as building new facilities or infrastructure, like roads or bridges.

All three; growth, baseline and forgone, are at the discretion of the officials elected to oversee the district. Budget growth is nearly universal but it does not need to be. The Post Falls Highway District has reduced their budgets by 1% for the last three years without negatively impacting services.

The limit that a budget can increase is set at 8%. Once the budgets are set then the total amounts of all the budgets from all the districts are forwarded to the Assessor.

Every taxable property in the county has an assessed value. If you own property you have likely received an assessment notice telling you the assessed value of your property. The assessed value May be lower than the market value, which may cause you to think you are getting a break on your taxes. You’re not.

To determine the tax you pay, the total of all the budgets is divided by the total value of the taxable property in that district. This produces a levy rate. The levy rate is the percentage of your property’s value that must be paid as property tax and is typically around 1%.

Imagine a simple district that has ten properties worth a million dollars each and the district has a $100,000 budget. The levy rate would go to $100,000 divided by $10 million which is 1%. Each property would pay 1% of its value in taxes which would be $10,000.

Now imagine the same district with the same budget but the Assessor has assessed the value of each property at $800,000. You may be thinking you will be paying less in taxes but the math says otherwise. The levy rate would be $100,000 divided by $8 million or 1.25%. That levy rate would be multiplied by your value of $800,000 to get your tax of $10,000, the same tax as before.

As the assessed values of the taxable property in a district goes down the levy rate goes up to collect the taxes needed for the budgets. The actual total assessed value of all properties in a district is not that important to you. What is important is that your property is assessed fairly and proportionally with all the others so that your relative tax burden is the same as your neighbors.

The Assessor could double the assessed values of ALL the properties in your district and it would not change the amount of tax you pay because the levy rate would be cut in half.

The legislature has set the limit that budgets can increase to 8% and has also shifted the tax burden away from homeowners and onto commercial properties and second houses by providing a Homeowner’s Exemption. The Homeowner’s Exemption reduces the taxable value of your home and up to one acre of land by 50% of the assessed value or $125,000, whichever is less. Changing the exemption has no impact on budgets but it does cause the tax paid by properties that are not a primary residence to increase.

When interviewing candidates, don’t ask them about taxes; ask them what they will do about the budget because it is the budget that you will feel when the taxman cometh.

It’s just common sense.