Photo by Micah Williams on Unsplash

It’s All Collapsing Now, and There is No Way out!

The Big Bond Bubble is bursting rapidly now, and it’s taking everything down with it, thanks to Fed inflation forcing the demolition of all Fed recoveries at the same time.

Wolf Richter is calling it a “bond bloodbath,” which he says is happening because delusions about the Fed’s fight with inflation are finally giving way. Reality struck home in the latest retail report that showed high increases in retail sales that were in good part due to high increases in inflation. (If you didn’t read The Daily Doom editorial about that yesterday, I highly recommend you do because this is a pivotal moment on the biggest issue that will bring down the economy: “Bonds Bust!”) The bond bubble is the biggest bubble in the “Everything Bubble” that the Fed inflated, so its breaking will bring down the entire “Everything Bubble.”

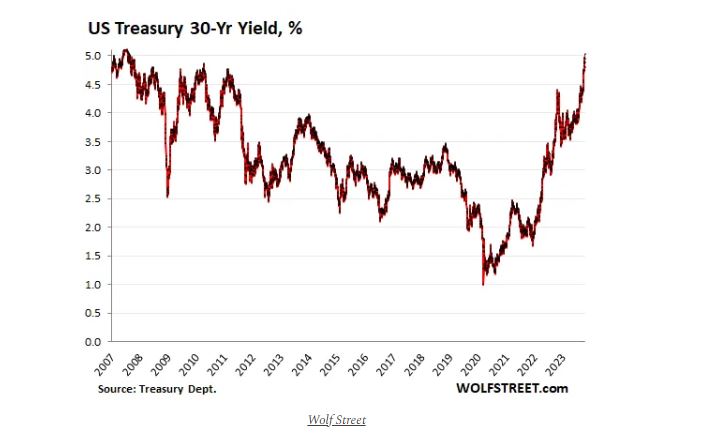

These long-term yields above 5% are an indication that a form of normalcy is gradually being forced upon the bond market by the resurgence of inflation, and by the belated realization that this inflation isn’t just going away on its own somehow. This is a huge regime change, after years of the Fed’s QE and interest rate repression, and all prior assumptions are out the window.

Here you can see how steep the rise in bond yields has been since the Fed started tightening and particularly since the bond market started waking up now that inflation is rising again:

Richter comments on the same things I’ve been harping about:

It seems, the long-term Treasury market is gradually coming out of its delusion about inflation and normalizing interest rates after having spent 18 months believing in the hype about a Fed pivot and rate cuts to something like 0% that would be forced on the Fed by a steep recession, with lots of forever-QE to follow, or whatever.

Delusion ends hard when the denial breaks up, and the Fed’s financial demolition is accomplishing that destruction now. If it doesn’t, inflation will do the job for it.

While the Fed will tighten us into a steep recession, the slide into this second plunge since last year’s dip will be especially steep because it will not likely come until the Fed tightens hard enough and long enough to break the “Everything Bubble.” That will plunge us rapidly into recession in an all-out panic because people who have been investing based on such enormous delusions panic when they finally realize that, like Wile E. Coyote, they’ve run out past the edge of a mighty high cliff.

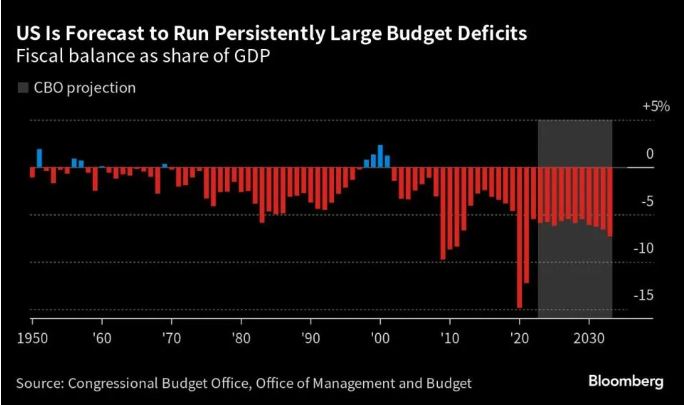

The crash of the Big Bond Bubble was inevitable because of the Fed’s QT and the Fed’s raising of interest rates and the government’s massive addiction to endless and enormous deficits, requiring massive new bond issuances. It’s just how supply and demand works:

This deficit-spending by the government has to be funded by piling enormous amounts of Treasury securities on the market that need to find buyers. Yield solves all demand problems by rising until demand emerges. And that’s in part what we’re seeing now. All of this is happening as the Fed is unloading its balance sheet at record pace, having already shed over $1 trillion in securities in a little over a year.

Market forces are taking over in determining bond yields now that the Fed is backing out as a buyer of that debt and the government is going deeper in as an issuer of new debt.

Higher yields mean lower prices. So this return to normalcy has been dishing out huge losses to investors who’d bought long-term bond funds or long-term bonds in the era of QE. Investors that own these way-under-water 30-year bonds outright can choose to hold the bonds to maturity at around 2050, when they will get face value back, and collect 1.5% or 1.8% coupon interest along the way.

Bond funds are breaking:

But investors that bought during QE are in a world of hurt. The iShares 20+ Year Treasury Bond ETF [TLT], which focuses on Treasury bonds with a remaining maturity of 20 years or more, fell another 1.6% today at the moment and has plunged by 51% from the peak in August 2020, which had marked the peak of the 40-year bond bull market that had turned into the biggest bond bubble ever (data via YCharts).

The unwinding of so much overindulgence in debt has raised mortgage rates to nearly 8%, which today’s headlines say is taking demand for mortgages down to its lowest level since 1995, back in a whole different millennium of housing. As I wrote about recently, this has, Richter says, put the housing market in a deep freeze.

Housing market in deep freeze.

Mortgage applications to purchase a home have been on a steady collapse-track and in the last reporting week slid another 6% from the prior week to hit a new multi-decade low, and are 48% below the same week in 2019

(You can read my full take on that here: “The Deeper Dive: The US Housing Market Has Frozen Over.”)

So, as the Big Bond Bubble bursts, the housing market tanks because mortgage rates are pegged off those bond rates. The demolition of the bond bubble takes housing down with it. With bond funds going bust and housing going deep underwater again, and bank reserves getting squeezed by the devaluing of their bonds, who can believe we won’t see more bank busts like those we already saw this year as these new yields on bonds rise even higher under free-market control, taking bond prices down lower? And with all that assured as the simple math of supply-and-demand, who can believe that will not finish off the bear market in stocks that began when the Fed started tightening by taking it down to its true low as everything around it breaks?

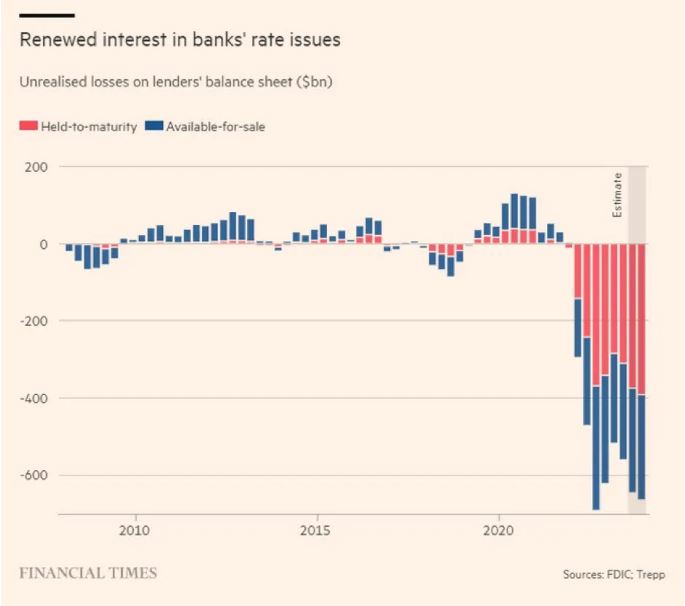

Another headline today claims “Losses in Treasury bonds will [be] far worse than mortgage losses in 2008. Banks in shambles.” It provides the following graph to show how deep the unrealized losses in bond values have been:

Those losses, of course, become realized losses if banks actually have to sell the bonds in their reserves to fund any flow out of the bank … as we saw last spring. You can see the potential for bank losses has formed into a gaping canyon that is still about as bad as it was at its worst in March.

Wall Street bond investors are worried about swelling US debt because the trend in deficits is a strongly established fact (and it likely projects out worse than the following graph because it always is worse than projected and because a recession created out of this mess is not priced into the graph, which will leave the US government much lower in revenue and needing to, at least in its opinion, open the stimulus taps even more):

The Federal Reserve faces potential policy pitfalls ahead as it wrestles with how to respond to investor angst about the US government’s $33.5 trillion mountain of debt.

Concerns about America’s fiscal future have already contributed to a run-up in US bond yields that has surprised policymakers and prompted them to consider postponing for now plans for another interest-rate increase.

If the Fed does postpone plans, it will be because it sees the bond vigilantes are doing its work for it now and pricing bond yields up, whether the Fed raises rates or not. At this point, the Fed will merely be running to catch up to what the free market is already doing just so it can appear to still be in control.

The Fed cannot help the government finance those massive deficits without spraying new gasoline directly into the inflation inferno it has already fueled, and the government cannot seem to stop itself from runaway spending. Even if it does manage to stop itself, the Feds’ roll-off of more Treasuries that have to be refinanced will continue to worsen the picture for bonds. So, will the rising of inflation, a major fear factor now that it is starting seen by investors to be back on the move.

The disquiet over deficits and debt puts upward pressure on long-term interest rates, threatening to slow growth and push up unemployment. At the same time, it can also act as kindling for higher inflation, especially if the Fed is perceived as downplaying its goal of price stability in order to limit the federal government’s borrowing costs.

The Fed has caught itself in the totally predictable trap I said it would end up in since the beginning of its “recovery” programs — one it originally laid in with stimulus plans that were never sustainable and that would collapse any recovery the Fed accomplished whenever the Fed withdrew from hosing up government bonds and allowed markets to price interest on those bonds naturally.

(See my little book “DOWNTIME: Why We Fail to Recover from Rinse and Repeat Recession Cycles: The same characters who created bailout bonanzas for banksters in the Great Recession are doing it again. Shall we let them?”)

And the Fed DOES have to withdraw because it is not allowed by law to carry the financing of the US debt. It has maintained it did what it did as a financial measure to set long-term interest rates to govern the economy, not for the government; and the proof of that, it claimed, would be that someday it would unwind all of that so the government would have to finance everything itself. Someday finally came, but it can’t actually do what it has said it will. We saw it fail last time it tried.

Until now, the bond market has foolishly believed the Fed will cave in on the inflation fight and go back to QE or foolishly believed that the Fed’s inflation fight would be easily won. This week’s economic news shined a bright light on the fact that all of that was fantasy. Realization about the inflation fight that remains is repricing everything.

The inevitable inflation fix

Markets may settle down for a bit in renewed denial if Powell tells them on Thursday that the Fed will hold on doing another interest-rate increase, but if the Fed does that, inflation will continue to flare up worse, making the whole situation worse down the line. Even if market rates that are now taking over, eventually rise enough on their own to fix the inflation problem by tightening the whole financial marketplace, the damage still happens. It just winds up happening on its own if the Fed backs off. The Fed still cannot intervene without ending that process and sending inflation back up.

The recent surge in 10-year Treasury yields will dampen economic growth, similar to a Fed rate hike. Bloomberg Economics estimates the increase since the Sept. 19-20 FOMC meeting, if sustained, should reduce the need for 50 basis points of interest rates.

“The threat of another hike will remain with us as long as we’re approaching inflation from so far above their target,” MacroPolicy Perspectives LLC founder and former Fed economist Julia Coronado said.

What we witnessed this weak was the tightening taking up the battle on its own as bonds repriced themselves for the reality of the renewed rise in inflation. One of my latests statements was that seeing that inflation was back to rising would, by itself, terrorize markets that have lived in perpetual delusion month after the month that the end was near for inflation. That realization made itself clear this week, showing inflation in some measures is already well on its way back to the very height from which it came down under Fed tightening. That is why this is a fulcrum moment in the nursing of the Big Bond Bubble. Reality set in with a thud.

Former Treasury official Mark Sobel — who served under both Republican and Democratic administrations — is blunter. Fed officials need to warn the public about the potentially deleterious impact of US profligacy on markets and the economy, said Sobel, who’s US chairman of the Official Monetary and Financial Institutions Forum, a research organization….

In August, Fitch Ratings Inc. stripped the US of its top-tier AAA credit rating while the Treasury announced a bigger-than-expected quarterly borrowing requirement. An estimate last week from the Congressional Budget Office that the deficit jumped by more than 20% in the just-ended fiscal year, to $1.7 trillion, added to the unease.

Of course, if the government cuts way back on that spending, that, too, will take the economy down as those are real projects run by real contractors hiring real people; and any cut in the size of government staffing is also real people going out of work. The cuts have to happen, of course, but they never come as a free move. The economic cost is deep in making such cuts, too, but there is no way the government can sustain its massive spending without the Fed carrying all the financing to drive down interest artificially all over again, which still means higher inflation. (In fact, more than the full extent to which GDP growth is positive is due to government spending via debt.)

“It’s just hard to believe that this is a sustainable policy going forward,” Fed Governor Christopher Waller said….

It’s not. Because it never was! The Fed’s artificial life-support, which the government became dependent upon because of more than a decade of loose financial policy, was never sustainable. The worse the mountain of enabled debt piled up, the worse the correction would be when the unsustainable course was ended. That has been my warning since we started down this path.

At this point, the inflation created by all that loose money once it came up against product and service shortages all around the world due to our Covid lockdowns and the labor damage that lasted long after the lockdowns, is forcing the Fed’s regime change. That makes this a whole different world now.

Administration officials insist that President Joe Biden is committed to reducing the budget shortfall and they argue that his initiatives to boost public infrastructure spending and promote private investment to fight climate change will help the economy in the long-run.

This is nonsense because we don’t have a long-run! Inflation is eating the economy up from the underside already. It will finish its destruction long before any hoped-for benefits from Biden’s Build Back Better kick in (if they ever do). And, in the SHORT-run, the plan hugely exacerbates inflation by demanding more labor and more materials, driving up the price of both for every entity and individual out there. By doing it on debt, we are simply using tomorrows money to price things up today!

Even if the Fed gives up on the fight, inflation, itself, is already tearing the Main Street economy down, and that will become far worse if the Fed gives up the fight. Warnings of this erosion are emerging from the biggest of vendors, such as Walmart, as well as the smallest,

Another story in the headlines below says, “Walmart CEO warns Americans will freak out this winter as prices continue to soar.” Wallmart describes how much it is already seeing consumers move away from its shelves, cut back their spending, and the story tells how shoppers are urging each other through social media to seek cheaper stores, such as Cosco to hedge against inflation. Walmart is feeling the bite.

Small vendors are feeling the bite, too. Another story tells how a small local marketplace where mom-and pop make their crafts and sell them is hurting due to inflation:

Small business owners that participate in UCF’s Market Day are encountering economic and developmental hardships due to the continuous increase in inflation in the U.S.

Inflation has continuously been a rising conflict that small business owners have struggled with, according to a September report made by the U.S. Bureau of Labor Statistics. The U.S also announced in August that inflation rates escalated another 3.7%.

“It just makes stuff more expensive for me on my end and then I have to raise the prices, but I try not to raise them that much because I like my prices,” said Maggie Borosky, owner of FoSew.Co. Borosky sells handmade scrunchies and custom hair accessories….

Market Day gives students the chance to stroll around the many different tents and buy things including clothes, accessories, plants and freeze-dried candy from small businesses. UCF’s Market Day provides small businesses the opportunity to expand their customers by participating in such a weekly event….

She said the continuous increase in inflation rates has negatively impacted her business…. According to a monthly report from the association, it was documented in May that the biggest issue faced by small businesses was inflation.

So, inflation is doing its damage to big and small throughout the economy, and that will get worse if the Fed doesn’t stay hard at the fight. There is no way out. It’s death by a thousand paper cuts with inflation or death by financial implosion if the Fed stays out of the bond market and forces the government to find other funders at higher yields — yields that reprice all interest upward, whether the Fed raises its stated targets or not because those Treasury yields are the peg for almost all market-set interest out there. Government debt is treated as risk-free from defaults, so all other credit has to price higher based on the amount of additional risk it entails, plus it has to price in anticipated inflation over the duration of the debt.

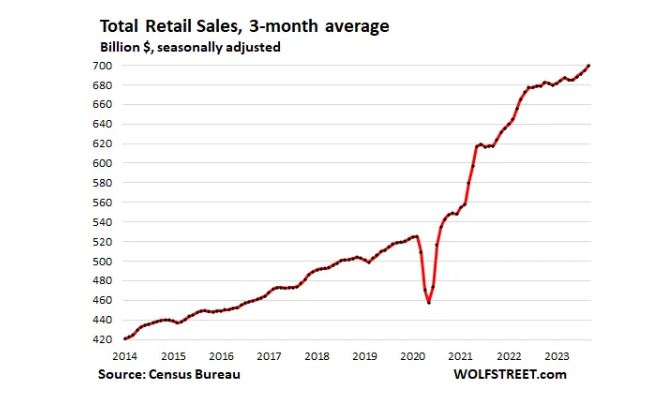

Here you can see a graph of how much retail sales have risen during the Fed’s robust funding era that came with the Covidcrisis:

That, however, does not entirely represent more products sold, so much as it represents the higher prices paid, since these sales are measured in unadjusted dollars. Consumers have used their stimulus money to keep up with inflation.

Retail sales outran inflation in goods by a wide margin. Retailers sell goods, and inflation has shifted from goods (from retailers) to services that retailers don’t sell, and the prices of many goods that retailers sell have dropped. The CPI for durable goods has dropped 2.2% year-over-year. The CPI for nondurable goods rose 3.2% year-over-year. Combined, total goods inflation rose by 1.5% year-over-year, less than half the year-over-year increase of retail sales of 3.8%

So, bad as inflation is, consumer buying has outrun it. That just means the pressure on inflation remains upward because consumers are not cooling enough to offset inflation. This they did with a combination of wage increase, stimulus savings and credit cards.

That does not mean the economy is strong. Many parts of the economy are broken. Labor was broken for a long time and is still below the trend it was on pre-Covid Wages are rising faster, but savings and credit cards are about maxed out, especially as the cost of servicing those credit cards has gone through the roof. Interest rates are taxing the life out of everything, but inflation is rising, not shrinking as it had been doing earlier in the year. Bankruptcies and defaults are surging. Some banks have already gone bust. Housing is going bust with homes beginning to sink back underwater (depending on where you are). I could go on and on, but the point is to say this is NOT a strong economy. The consumer is still buying, but the economy has structural wreckage throughout; so it will collapse quickly as the Everything Bubble Bust worsens.

Richter, in another article, lays out graphs for many areas of consumer spending to show what is happening in each. So, if you want the granular detail on retail, that article below is the place to go.

Critical inflection points in inflation

Other prices are also rising that I said would become a big contributors to inflation. Fuel went back to rising, after a respite I said we could anticipate. It is back to being over $90/bbl, on the rise today because of a huge takedown in inventories that was unexpected, as well as the war in Israel.

Oil prices gained nearly $2 in early trade on Wednesday after industry data showed a bigger-than-expected draw in U.S. crude stocks amid worries about supply disruptions from the Middle East due to a deepening Israel-Hamas conflict….

U.S. crude stocks fell by about 4.4 million barrels in the week ended Oct. 13, according to market sources citing American Petroleum Institute figures on Tuesday. That was much steeper than a 300,000 barrel draw that analysts had forecast.

And then there was big news on those healthcare costs that I said will finally show up in CPI in the next report now that the government’s truth-masking adjustment is ending. A report today shows that health insurance actually rose 7% over the past year, never mind that it got reported in CPI as declining all of the past year due to the adjustment that was intended to reconcile past years’ mistakes, making overall inflation look lower all year than it really was.

Health insurance now costs employers and employees an average of $24,000 per year per employee!

The acceleration in 2023 is particularly threatening to employers amid rising prices for other goods and services. The cost of premiums is typically shared between employers and workers, with companies paying 71% on average for family coverage in KFF’s survey.

“There’s no way to cut it other than to say that’s a huge number,” said Matthew Rae, associate director of KFF’s Health Care Marketplace Program and a co-author of the report. “To a family of four, you’re basically spending pretty close to what a new car costs, just for the year, to keep everybody covered.”

A huge number ALL year that was reported as a NEGATIVE number all year! As those increases continue, they will now be showing up in CPI, assuring CPI inflation rises faster. There is no hiding the truth now.

There is no way out either. This was the Fed’s endgame all along, though it didn’t know it. There simply never was an endgame that would allow them to unwind their balance sheet and normalize interest rates again without bursting (or imploding) all the bubbles they ever created.

And with that, the 10-YR Treasury bond has repriced itself up another seven basis points today to hit and hold at 4.9% from 4.84% at the end of yesterday, and that’s why stocks dove again today, down 333 points on the Dow (-0.98%) and 219 points on the Nasdaq (-1.6%). Inflation and natural bond pricing will do the dirty work from this point on, even if the Fed doesn’t. If the Fed ever fights that, inflation will work harder, and it will win.

“The bar is very high” to the Fed veering from that path, Coronado said.

The rise in yields is threatening to make the untenable fiscal outlook even worse, said former CBO Director Douglas Holtz-Eakin, who advised George W. Bush while he was in office.

“We have a super-interest-sensitive budget,” said Holtz-Eakin, president of the American Action Forum. “If the bond market is starting to decipher more accurately the effective fiscal position of the US, then we’re in trouble.”

We ARE in trouble, and there is no getting out of the building before it collapses.

From thedailydoom.com