WA State Impact of CO2 tax levels off at 24 cents per gallon

By Todd Myers

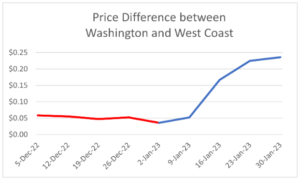

The impact of Washington’s new tax on CO2 emissions leveled off in the last week, adding about 24 cents to the price of a gallon of gas compared to other West Coast states.

After last week’s estimate, we reexamined the calculations and revised the estimate for last week downward to about 22 cents per gallon. Due to the difficulty of disaggregating the various influences on gas prices, there will always be a margin of error, so the amounts are estimates.

To get a better idea of the impact of the tax on gas prices we used two methods of calculation.

The best source of information is probably the U.S. Energy Information Administration (EIA) which receives reports from gas stations across the country every week and reports the aggregated data on Mondays. We use their estimates for the average price of Regular gasoline for the Western States, removing California because it can be an outlier. After removing the impact of Washington’s prices on the rest of the West Coast, we compared Washington’s current prices to average price differential in December.

The best source of information is probably the U.S. Energy Information Administration (EIA) which receives reports from gas stations across the country every week and reports the aggregated data on Mondays. We use their estimates for the average price of Regular gasoline for the Western States, removing California because it can be an outlier. After removing the impact of Washington’s prices on the rest of the West Coast, we compared Washington’s current prices to average price differential in December.

In December, Washington’s prices averaged about 5 cents per gallon more than the rest of the West Coast. In the middle of January, that number jumped up dramatically, and continued increasing, reaching 29 cents per gallon this week, which is 24 cents more than prior to the CO2 tax taking effect.

The EIA data is good quality but includes states like Arizona and Hawaii – which are fairly distant from Washington – but does not include Idaho. Unfortunately, the EIA does not report Idaho’s gas prices, so it is hard to adjust for this using their data.

To include Idaho in the comparison, I turned to AAA, which regularly updates prices and includes data from the past month. Using the same states included in the EIA’s estimate – Alaska, Arizona, Hawaii, Nevada, and Oregon – and adding Idaho, the price increase comes to about 25 cents per gallon. Virtually identical. If we use just Oregon and Idaho, it comes out to 24 cents.

The relative stability of the various calculations seems to confirm that the estimate of 24 cents per gallon is reasonable.

Interestingly, last week someone criticized the fact that I referenced the price comparison to Idaho, claiming it increased the relative price increase. Using the current AAA data, it is the opposite, although the effect on the average is just one-third of a penny. Washington’s prices have increased less when compared to Idaho versus the other states mentioned.

The governor and some others have claimed prices were being driven by global markets, the war in Ukraine, oil company “greed,” or other factors outside the state. The sharp increase shows that is wrong. Washington’s prices jumped dramatically soon after the CO2 tax took effect, more than any other state on the West Coast, and much more than the average.

State agencies continue to claim the impact of the CO2 tax will be small – they estimate about five cents per gallon. This estimate is contradicted by the State of California as well as energy economists like the Energy Institute at Haas at the University of California at Berkeley. It is also contradicted by the real-world data we are seeing.

State agencies like the Department of Ecology have also argued that fuel distributors don’t have to pay the tax until next year and shouldn’t be raising prices now. Technically this is also true of my income tax. It is either due next April 15 or is due in quarterly payments. Despite that, a portion of my income is withheld to cover the taxes even though they are not yet due. The same is true of fuel distributors, who are incurring liabilities for every gallon of gas, propane, diesel, and other fuels they sell and are collecting the taxes now. Ecology’s argument is simply disingenuous.

We will continue to track the prices but if the trend of the last week holds, we may not see significant changes until the first auction of allowances occurs at the end of February and the actual price of the tax is known.

From washingtonpolicy.org