2022 End of Idaho Session Report – By Sen. Steve Vick

04/02/2022

Dear Friends,

Below are some recent activities and highlights taking place in the Idaho Capitol. I hope you find this informative. For more details, you can go to legislature.idaho.gov where you will find bills, committee recordings, and live stream videos of our House and Senate floor sessions. I appreciate your interest and involvement.

Best regards,

Steve

The Second Session of the 66th Legislature kicked off with the Governor’s State of the State Address. His priorities echoed our own – continuing our work for meaningful tax cuts, ongoing improvements in education and educational outcomes, repairing our infrastructure and protecting our land and water resources.

The Legislature worked diligently to address these issues and immutable priorities like protecting our freedoms and our rights. Throughout our work, we kept our constituents front of mind and made sure we were looking out for Idaho families and children, those who make their living from the land, and our business owners.

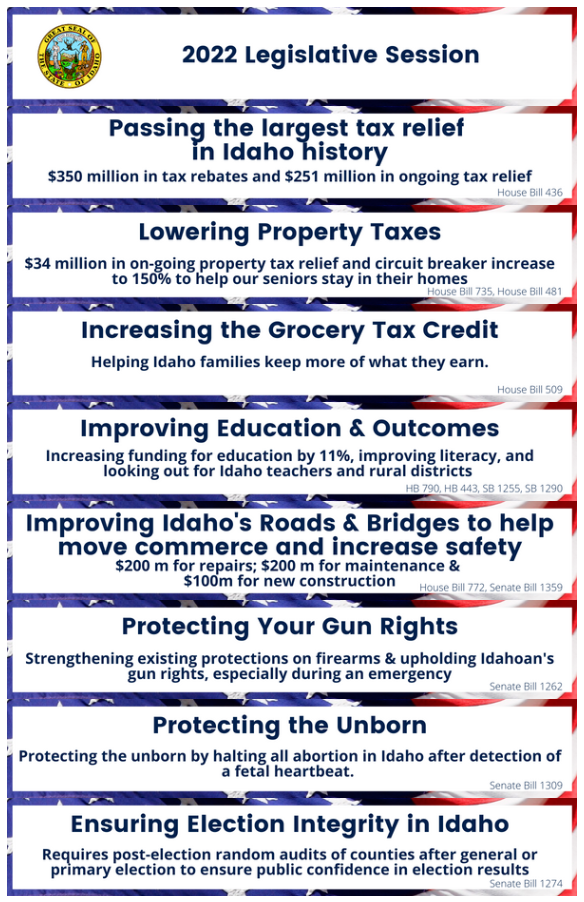

Over the past four years, the Idaho legislature has passed three of the largest tax cuts in state history. Tax cuts dominated the early part of the session as the first bill to pass both houses of the Legislature and signed by the Governor was House Bill 436 (H436). This record-breaking tax cut included $251 million in ongoing tax relief. The bill also consolidates and simplifies the tax brackets from five to four. The four brackets will see retroactively lowered rates of 1%, 3%, 4.5% and 6%. The bill also lowers the corporate tax rate to 6% and provides a one-time $350 million tax rebate on 2020 personal income tax.

The Legislature also passed a circuit breaker property tax reduction in House Bill 481. This bill increases the circuit breaker for homes to 150% of the median assessed value. It also states any residence under $300,000 will qualify for a circuit breaker regardless of the percentage its assessed value over the median value. The purpose of this bill is to provide property tax relief to our senior citizens, widows, and certain others on low, fixed incomes.

House Bill 509, also passed both houses and includes a $20 increase in the grocery tax credit for all Idaho taxpayers. This $20 will be added to the $100 credit already in place. This tax rebate is for Idaho residents only and by focusing on a credit, we keep the benefit with Idaho citizens and still receive the benefit for taxes paid by tourists and out-of-state visitors.

House Bill 735 will also provide a significant tax cut in the form of prospective property tax reduction by providing almost $34 million in on-going property tax relief. This will come about from counties being able to eliminate the responsibility for the indigent payments and not having to pay for public defense costs, eliminating the need to raise property taxes to cover these expenses. This tax relief plan passed overwhelmingly in both chambers and was signed into law by Governor Little on March 29, 2022.

Education is the engine of economic growth and opportunity. We approved and passed an 11%+ increase for K- 12 education funding for this year and a nearly 6% increase in higher education funding. Included in this appropriation was a critical piece of legislation (House Bill 790) that tackled K-12 literacy funding for school districts to use for early literacy programs, including optional full-day kindergarten that kept the choice at the local district level.

We also passed House Bill 443, which sets up a fund to bring school district employees’ health care coverage standards in line with state employees. There has been a $4,100 gap between what is spent each year on state employees’ healthcare coverage versus what is spent on teachers’ healthcare coverage. This bill will help close that gap and make healthcare more affordable for Idaho’s school district employees and allowing our teachers to take home more of their pay.

In all this we made sure Idaho’s parents are in charge of their children’s futures. We established the Empowering Parents Grant Program (SB 1255), a program that provides funds for eligible students for computers, textbooks, physical therapy, and other education expenses, allowing parents to customize their child’s education.

The legislature also recognizes the importance of increased transportation funding to address aging infrastructure, safety and to make sure Idaho goods and commodities can make it to market. Idaho continues to be a growing state and our infrastructure is being stressed and is wearing out. We increased transportation funding (Senate Bill 1359) by $200 million for bridge repair in Idaho, many of these bridges dating back 50+ years. House Bill 772 appropriates another $200 million for road maintenance split 60/40 between the state and local governments. House Bill 787 appropriates another $100 million targeted for new construction.

Because of prudent financial management we were able to fully fund known transportation needs – to maintain our roads and bridges permanently – with no new taxes. These transportation appropriations will ensure our commerce continues to flow in and through the state. The maintenance and new construction will also help keep our citizens safe as they travel on our busier highways and roads.

We are always focused on protecting Idahoans’ rights. With the passage of Senate Bill 1262 we upheld Idahoans’ rights to purchase ammunition, components and accessories during an emergency and prevented concealed weapon laws from being circumvented during declared disasters. It ensures that firearms be exempt from the section of Idaho code that allows the government to confiscate personal property (such as construction equipment) if needed in an emergency. It also declares that firearm-related commerce be established as an essential service, and therefore could not be closed in the case of a shutdown.

We work to protect the most vulnerable in our society and on March 23, Idaho became the first state to enact a law modeled after a Texas statute banning abortions after about six weeks of pregnancy and allowing it to be enforced through lawsuits to avoid constitutional court challenges. Senate Bill 1309 was modeled after the Texas law allows people to enforce the law in place of state officials who normally would do so. This law authorizes lawsuits against clinics, doctors and anyone who “aids or abets” an abortion that is not permitted by law. The legislation is aimed at protecting the unborn by halting all abortion in Idaho after detection of a fetal heartbeat.

Idaho is and remains one of the most incredible places to live. And, we are in a great place financially, even as we manage significant growth. Under the fiscal leadership of the Republican Majority, Idaho is one of the least regulated states in the Nation, our unemployment rate has fallen to a pre-pandemic level, and people from around the country are looking at what Idaho is doing right. Returning taxes back to those who pay them stimulates our state and local economies and helps Idaho’s families. Increasing funds to fix our roads and paying our teachers for their valuable work, also helps our communities grow and flourish. Idaho is on the right track and will continue to be an example to other states.

State Capitol | P.O. Box 83720 | Boise, Idaho 83720-0081 | (208) 332-1044