Idaho Legislative News: January 2022 Week 2

Dear Friends,

Below are some recent activities and highlights taking place in the Idaho Capitol. I hope you find this informative. For more details, you can go to legislature.idaho.gov where you will find bills, committee recordings, and live stream videos of our House and Senate floor sessions. I appreciate your interest and involvement.

Best regards,

Steve

Legislature Focuses on Record-setting Tax Relief

This week the Idaho Legislature worked to advance the most significant tax cut in Idaho history. HB 436 provides a record $600 million in tax cuts and rebates, surpassing last year’s similar legislation. It includes $350 million in one-time rebates and $251 million in ongoing income tax rate reductions for individuals and corporations. The bill was introduced last week and quickly moved through the House Revenue & Taxation Committee. It heads to the Senate Local Government & Taxation and is expected to pass and move the Senate floor with strong Republican support.

A Look Back at 2021

Despite the challenges brought on by COVID-19, the Idaho Legislature remained open, one of the few legislatures in the country who made the decision to stay in session and continue to represent our constituents. In so doing, we had a very successful and productive legislative session, resulting in new growth and forward movement for the state of Idaho.

Notable accomplishments include: reducing the personal income tax rate from 6.9% to 6.5%, and reducing the Workers Compensation tax rate. Idaho was also the only state able to deliver a tax rebate to its citizens, despite the difficulty presented by the COVID pandemic.

Important legislation related to COVID19 was passed, restoring the balance of powers between the legislative and executive branches. As a result, the director of the Department of Health and Welfare is prevented from forcing healthy Idahoans to quarantine (S1139) and elected County officials have the power to review and reject or approve any Idaho public health district order (S1060). Finally, Senate bill 1217 declared that all Idaho workers are essential and safeguards your 2nd Amendment rights.

Our activity extended beyond COVID-related issues, however. We worked to ensure election integrity and passed bills that prohibit the use of private money to help run elections (S1168) and prevent voter fraud by restricting the ability of any voter to request a different absentee ballot (S1064).

Finally, education is always a top priority for the Idaho Legislature. In 2021 we passed several bills to improve our educational systems, including H377 which prohibited the teaching of Critical Race Theory in Idaho schools and S1006, which improves reading assistance to help students in K-3 read at their grade level. We also passed legislation increasing teacher pay (H385) and provided funding for the teacher’s Career Ladder (H222), creating a strong foundation for this year’s efforts.

Idaho State Board of Education Budget Discussions

On Monday morning, JFAC held a hearing on the budget for K-12 public schools. State schools Superintendent, Sherri Ybarra, presented her budget request, both for K-12 schools, and for the state Department of Education. During her budget pitch, Ybarra stated that Idaho’s school students suffered learning setbacks during the pandemic that urgently need to be addressed. Ybarra stated, “I am here to advocate for additional investments in education, given the record surplus that we are fortunate to have as Idahoans this year.” Ybarra called for a boost in operational funding for school districts; a $3M increase in advanced opportunities funding that pays for students in the 7th grade and up to earn college credit; higher pay for teachers and other school employees; and $39.3M to cover the costs of optional full-day kindergarten for all at-risk students.

Rep. Caroline Nilsson Troy said in an interview, “The thing that I like about hearing the education budget first is that it is our biggest priority and as the governor has mentioned in the past, it is also our biggest moral priority, so it seems appropriate to start there. It really sets the tone for the rest of our budget hearings.” Over the next five weeks, JFAC members will hear proposals for each state agency and program. February 18th is the target for JFAC to wrap up budget hearings and transition into budget setting.

Governor Little Shares Top Priorities

The 2022 Idaho Legislative session opened on Monday, January 10, 2022, with Governor Little’s annual State of the State address. The Governor outlined his legislative and budgetary priorities for FY2023. Governor Little’s Leading Idaho plan sets out to put more money back in the hands of Idaho citizens while investing in education and other policy areas.

EDUCATION

Education remains the top priority. He has recommended a $300M investment in Idaho’s public schools, an 11% increase over the prior year. His budget recommendations include $1,000 bonuses for all teachers, investments in the career ladder, $47M in literacy programs, and $50M dollars for Empowering Parents Grants, which help families take charge of education expenses for their children. Further, he has proposed targeted investments in higher education, a $10M investment in Career Technical education, and a recommendation to direct $50M from the American Rescue plan to the Workforce Development Council.

TAX RELIEF

The Governor has recommended record-breaking tax relief that will put $1.5B over five years back into Idahoan’s wallets. Within this proposal, the Governor has proposed $350M in income tax rebates and lowering income tax rates.

INFRASTRUCTURE

Governor Little set out ambitious plans for Idaho’s aging infrastructure, including transportation and broadband. He has proposed fully funding existing maintenance needs for Idaho’s roads and bridges, including a $200M one time investment to improve local bridges. His plan proposes investment in airports, rail, port and pedestrian safety to secure Idaho’s supply chain and safeguard Idaho’s economic future.

Idaho stands to receive more than $340M from the federal Infrastructure and Jobs Act that has been earmarked for highways and bridges ($117M) and $225M to upgrade broadband infrastructure, to ensure all of Idaho’s communities can access remote work opportunities, telehealth and distance education.

Overall, Idaho is on track to have a $1.9B budget surplus this year, a record breaking number and one that will require careful consideration and planning for the future. These are just some of the issues we’ll be discussing this session, and considering carefully to ensure that Idaho’s citizens benefit from the record-setting surplus, living within our means, and planning for our future.

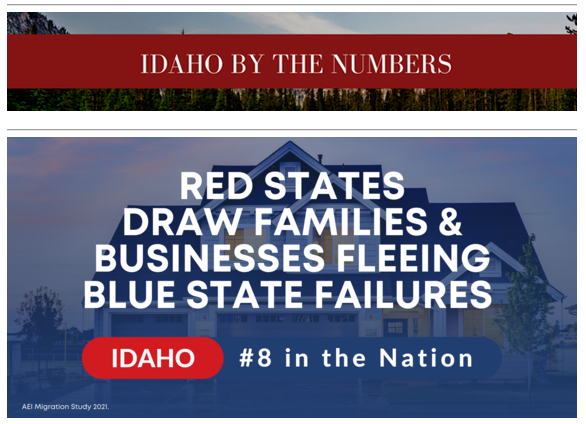

American Enterprise Institute studied states people are moving to and states they’re leaving. They looked at 14 measures and found empirical evidence that Americans and firms are “voting/moving with their feet.” They are moving from Blue states with high-tax, business-unfriendly, fiscally unhealthy, economically stagnant conditions to Red states, like Idaho, to find lower-taxes, more business-friendly regs, fiscal responsibility with strong economies, lower electricity and housing costs.

HB 441 This bill offers absentee ballot assistance for those in nursing care facilities by designating three authorized sources of voter assistance. Referred to House State Affairs.

HB 436 Income tax rebate; reduces independent and corporate income tax rate. House passed 57-13; moves to the Senate

HB 448 This legislation repeals the sales tax on food sold for human consumption, using the definition of food products provided under the Federal Supplemental Nutrition Assistance Program (SNAP), excluding prepared food. To offset the reduction in sales tax revenue sharing amount to local units of government, the bill increases the revenue sharing percentage to the units and saves $13 million which would have been transferred to transportation in revenue sharing. Reported Printed and Referred to Ways & Means

HB 450 This proposed legislation will provide employers with unemployment insurance tax rate stability and consistency by extending the 2021 unemployment insurance base tax rate over a period of two years. This will result in a tax savings of $64 million for Idaho businesses over the next two years. Introduced, read first time, referred to JRA for Printing

State Capitol | P.O. Box 83720 | Boise, Idaho 83720-0081 | (208) 332-1044