Pushing on a String

By Mark Lazar

The four most expensive words in the English language are, “This time it’s different.” Sir John Templeton

Despite ongoing uncertainty regarding US/China trade, Brexit, and an increasingly frosty climate with Russia and Iran, the capital markets have richly rewarded investors in 2019. After hitting record highs in July, the equity market sold off a bit due to the president’s surprise announcement of additional tariffs on Chinese goods, which are scheduled to begin next month. Even so, it’s been a banner year for investors.

With above average growth, strong labor markets, increasing productivity, rising wages, tame inflation, and a strong dollar, the US economy is the envy of the world. It isn’t perfect, but then again it never is. However, most equity indices hit record highs this past month, the housing market is strong, household wealth is at an all-time high, and business and consumer confidence are both within a couple of points of their twenty-year high. What’s not to like?

| Item | Data point |

| S&P 500 Return YTD | 18.32% |

| Bond Index Return YTD | 7.14% |

| Foreign Index Return YTD | 10.61% |

| Emerging Market Index YTD | 3.93% |

| U.S Forecast GDP 20191 | 2.60% |

| Unemployment Rate | 3.70% |

*All hyperlinked data as of 8/3/2019

1Kiplinger’s, 5/27/2019

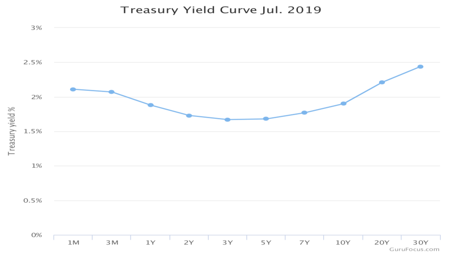

But it’s not all is sunshine and rainbows. The yield curve depicted below should be upward sloping, meaning investors are typically rewarded for owning longer term bonds. While the yield curve isn’t fully inverted, it is clearly abnormal. Markets are forward-looking, so one possible explanation is the markets are pricing-in future rate cuts by the Federal Reserve. Assuming the long-end of the curve remains as is, a reduction of short-term rates would normalize the curve. But even if this comes to pass, interest rates would be far below historic averages.

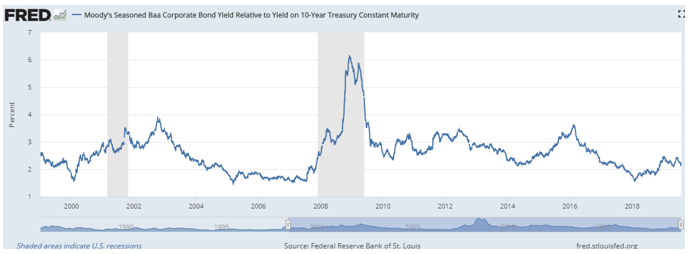

Economists can glean much insight from the credit markets. Besides the yield curve, two other important data points are credit spreads and the 10-year Treasury yield. Credits spreads are merely the interest rate differential between a risky bond (i.e. corporate bond) and a risk-free bond (i.e. US Treasury bond). The difference in yield represents the market’s required risk premium, or the additional yield a reasonable investor requires to assume credit risk, or the risk of possible default.

The long-term average credit spread appears to be around 2 ½%, and when spreads hit 3% or more, the economy tends to slip into a recession (the shaded areas). Today the spread is 2.17%, so the market is clearly not concerned about credit risk or pending economic contraction. Rising credit spreads have historically been the canary in the coal mine and a good forecaster of future economic woes. But at 2.17%, the canary seems to be chirping away with nary a care in the world.

In contrast to sanguine credit spreads, the 10-year Treasury yield, at 1.85% , is a source of consternation. The bellwether Treasury began the year at 2.66% and subsequently fell three quarters of a percent before the Fed dropped the benchmark federal funds rate by .25% at the end of July. While not a perfect predictor, historically, economic growth tends to be marginally higher than the 10-year Treasury, and inflation tends to be slightly less. Meaning as Treasury yields fall, so do future economic growth prospects.

It is with Sir John Templeton’s sage warning ringing in my ears that I shall attempt to explain the current anomalous yield curve; there are currently a number of countries issuing debt today with negative yields out to ten years. The list includes; Switzerland, Germany, Netherlands, France, Japan, Finland, Sweden, Belgium, and Denmark. The current total of outstanding negative yielding sovereign debt is over $14 trillion. This is very bad monetary policy, causing both malinvestment and unforeseen consequences. But it also explains why foreign investors are clamoring to US Treasury bonds; they can either park their money in a 10-year Swiss bond at roughly -1% or a US Treasury bond at 1.85%? Excluding currency values, over ten years the difference is roughly 30%. Gee, let me think; I’ll take the US Treasury for one hundred, Alex.

Reading the economic tea leaves is an imperfect science at best. However, the US economy is currently on very sound footing and there are no storm clouds on the horizon. And while a bit more tepid, the global economy doesn’t appear to be in imminent danger of contracting any time soon. But negative interest rates are not the panacea for what ails Europe and Japan. Rather, the medicine they desperately need are pro-growth fiscal policies, that reward innovation, capital, entrepreneurship, hard work, and risk-taking. Low interest rates may provide some initial economic stimulus, but eventually it’s like pushing on a string.

Mark Lazar, MBA

Certified Financial Planner®