Why Should Coeur Terre be Taxed as Farmland?

By Idaho Slow Growth Research

Fake Farmers, Taxes, and “Saving the Prairie”

This article questions why wealthy equity firms, such as the Lakeside Company, should have their investment property taxed as if it was farmland, when they are obviously holding it for development and speculative purposes. It follows up on a previous article on Coeur Terre taxes.

The Idaho Tax Code provides for a definition of farmland that is broad enough to bestow extremely favorable tax rates on land speculators and corporate developers as well as actual farmers. In former times, when “global capital” had other preoccupations than Idaho and our land values were still moderate, this was not terribly noticeable, but now it is.

The value of land is influenced by many factors other than taxes, but in general, the problem of artificially low taxes on property is similar to that of artificially low interest rates. Both reduce the cost of investing in property and therefore drive-up property values in a way that favors corporations and moneyed interests over individuals.

There is a naive belief among many area residents, that it is a good thing to subsidize agriculture, and that the prairie might be preserved if we make it possible for existing farmers to resist development pressures. Certainly no one wants to see the prairie destroyed by endless subdivisions, or legacy farming families driven off their land. But granting agricultural tax breaks to investment corporations who are holding property for future development, is probably counter productive. One does not “save the prairie” by making it cheap and easy for developers to hoard property.

It may be the case that advocating for low density, suburban-rural development—as in large residential lots, hobby farms, and small-scale, home based businesses,—is healthier for the region than subsidizing investors who pretend to farm while they wait their turn to pave over the prairie.

The massive, intrusive Coeur Terre Planned Unit Development, that is now transitioning from isolated farmland to a “Master Planned Community” is Exhibit A of the failure of agricultural tax breaks to actually preserve farmland. Subsidizing fake “investor” farms will not preserve our prairie. It is a direct route to the complete Californication of our beautiful valley.

The FAKE “Market Value” of Coeur Terre

The Coeur Terre Property is a prime example of how granting tax breaks to Fake Farmers is helping to drive up local property prices and subsidizing rapacious development monopolies.

Several months ago, NISGR began researching the agricultural tax exemptions on hundreds of acres of Coeur Terre property. What we found, however, was that there were no agricultural exemptions. They were not needed because the “market value” of the property was utterly falsified. It appeared to us that Idaho’s lawmakers had taken tax-code shenanigans to a new level.

The article Why are Coeur Terre Property Assessments so Low?, exposes the extremely rigged, artificially low “Market Value” of all the Coeur Terre properties, but does not explain how it came about. The purpose of this article is to explain the complicated, rigged tax evasion scheme that is an answer to that question. So we recommend reading the previous article before proceeding with the description of the latest manipulation of Idaho’s agricultural tax code.

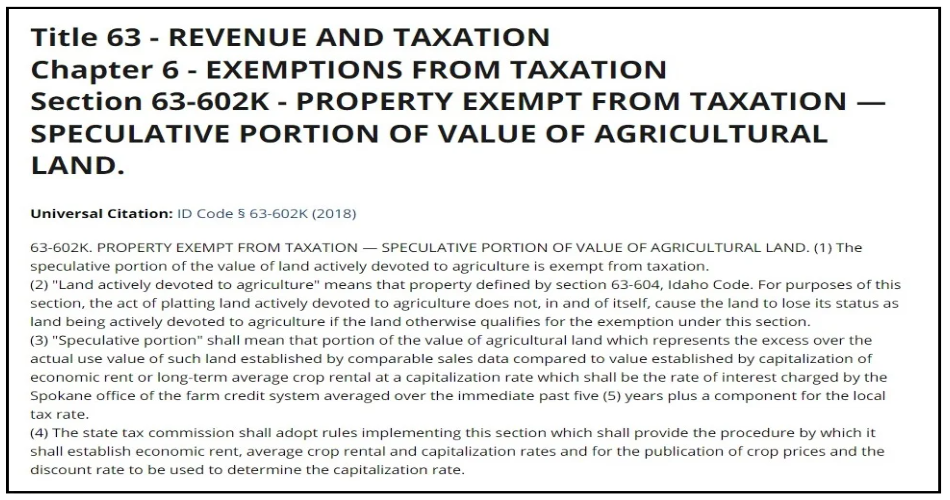

Exemptions for the Speculative Value of Farmland

In Idaho, the “actual use” value of agricultural land is low because the climate is not favorable for high yield farming. The “use value” of land used for hay farming, for example, is only about 2-3K per acre in most cases. Therefore, in order to protect farmers whose land’s “market value” is higher than its “use value”, Idaho Tax Code has long provided an exemption that applies to the Speculative Portion of the Value of Agricultural Land. In remote regions this exemption is valuable, but not terribly so. But in places like fast-growing Kootenai County, the ability to buy land and hold it for years while paying almost no taxes, saves investors tens of thousands of dollars annually, and makes land speculation a very profitable activity.

Investors whose property is outside city limits are greatly limited in how much they could build on their property if they decided to develop it, so it is “only” worth approximately $50K per acre (or 25x the “use” value of agricultural land). But once property is annexed into a city, its potential value is usually well over $500K, or 250x is “agricultural” value.

For this reason, granting tax benefits to developers who invest in agricultural prairie land isn’t a glaring problem until their property is annexed into a city. After all, the goal of these exemptions is to promote farming. But once a parcel of land is incorporated into a city, rezoned, and platted, it seems that developers should lose their generous “farming” tax advantages. However, Idaho’s agricultural exemption was defined so broadly that it could be applied to any parcel that is actively being farmed, even if it is within a city’s boundaries and has been rezoned and subdivided.

Obviously these extensions were made, not to benefit farmers, but to benefit developers, so they could keep their artificially low tax rates right up until the bulldozers move in. And in the case of Lakeside Company, who may take decades to complete the “build-out” of Coeur Terre, this is a monumental case of having your cake and eating it too.

But even this wasn’t good enough for the owners of Coeur Terre. They wanted more.

House Bill 0560: “An Act Relating to Taxation”

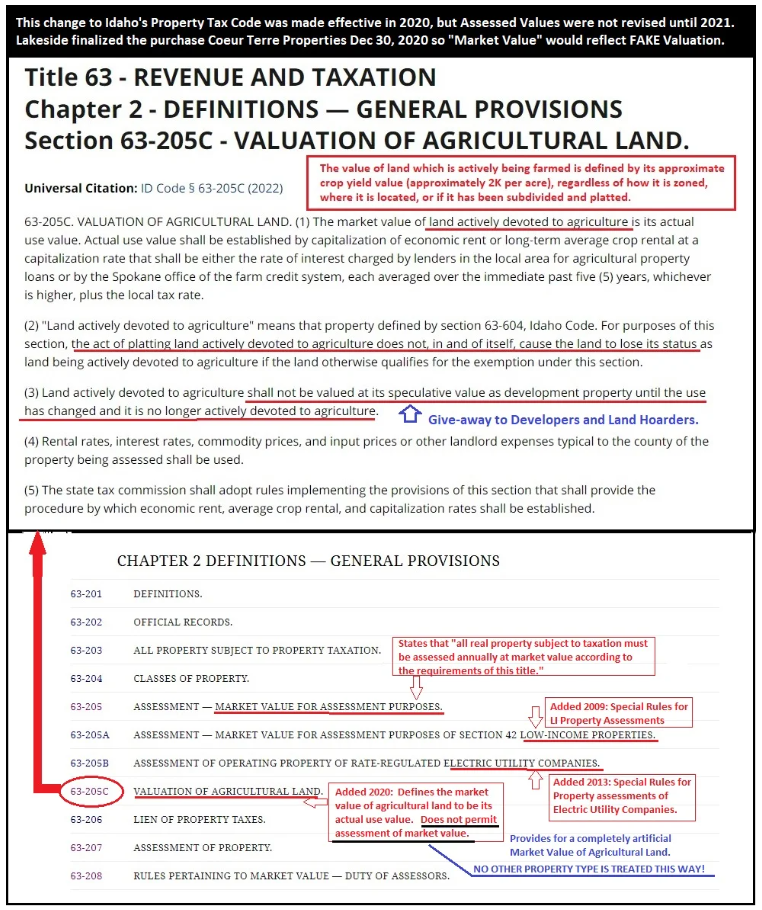

In March of 2020 House Bill 0560 was brought forward to the “Local Government and Taxation” Committee of the Idaho legislature. It was described as “Amending existing laws to provide for the valuation of agricultural land” without further explanation. It was presented as a bill that made “technical corrections” and was “revenue neutral” since agricultural landowners already qualified for a generous tax exemption.

The real purpose of this bill, however, was to redefine farmland in such a way that it would be impossible to determine what portion of any agricultural land was “speculative” since only its “use value” would be recognized by the assessor. One result of this, of course, is that the artificially low tax rates paid by fake farmers would be locked in, regardless of any limits placed on exemptions.

But another result of this change in tax code was that the market value of all agricultural land in Idaho would be permanently hidden from prying eyes. If a regular home-owner buys a residential parcel, then the price they paid for the property and a record of its assessed value over the years is public information that can be accessed from the Kootenai County Parcel search website. Not so, however, with fake “investor” farmers. If you are a wealthy land-holding corporation, records pertaining to the “market value” of your “farmland” simply do not exist. There is no longer such a thing as “market value” of farmland in Idaho. It has been “defined” out of existence.

House Bill 0560 passed unanimously in both the House and Senate and became effective in July 2020. However, the “market value” of agricultural land was not eliminated in the assessor’s records until January of 2021.

By sheer coincidence Lakeside Capital completed the purchase of Coeur Terre on the last business day of 2020 so its purchase price was not recorded and the property’s market value has never been assessed.

Echoes of Communism: Market Value Determined by Statute

House Bill 0560 made several changes to the Idaho Tax code. First of all, Title 63-602K, the Property exemption for agricultural land was removed altogether. Agricultural exemptions no longer exist, because the speculative portion of farmland value has been defined out of existence.

What was added to the tax code was an entirely new definition of the “Valuation” of Agricultural Land, and it is completely novel. Not only is this an obvious give-way to developers and large landowners (many of whom have powerful connections in Boise), but it is a radical departure from all previous principles of land assessment and taxation.

The idea of arbitrarily setting the “market value” of over 14 million diverse acres of agricultural land by fiat and tying it to a formula for long-term crop rental rates rather than actual purchase prices, is pure communism, grossly unfair, and a terrible indicator of how much power land-barons and monopolistic development corporations wield over Idaho’s state government.

Special rules for assessing certain property types have been imposed in the past, always as the result of lobbying and cronyism. But the whole idea of eliminating “Market Value” as a category is far more drastic and it is a deeply disturbing precedent that directly contradicts existing statutes: Title 63-205 “Market Value for Assessment Purposes.

Subsidizing FAKE Farmers will NOT “Save the Prairie”

We would all love to “Save the Prairie”, but we have to face the fact that hay or crop farming is not a profitable enterprise in the Rathdrum Prairie, and those of us who would like to prevent our beautiful region from turning into California, need to avoid falling into the trap of thinking that subsidizing hay farming for land Barons will be an effective way of preserving what we love.

A few things to keep in mind: First, Low density, suburban-rural development may be a better defense against high density corporate development that non-economic farming. Large lot suburban and two to twenty acre mini-farms, whose private owners reside on the land and pay full value property taxes, are likely to be much better stewards of the prairie than investor-owned, Fake Farming LLCs.

And where it does make sense to develop single family homes, smaller developments with fewer deed restrictions, and less conformity among housing types are far less oppressive than gigantic “Planned Unit Developments” such as Coeur Terre, where “Master Planners” have pre-decided the location of every tree and the color of every windowsill.

The corporate “Planners” of Coeur Terre, with their elaborate designs for a pre-planned, pre-packaged, self-contained, futuristic community, copied straight out of the Globalist “Smart Growth” handbook, don’t seem to understand that human beings need agency, and the ability to make decisions affecting their environment. They seem, in fact, to have forgotten what it means to be human altogether, if they ever knew.

From idslowgrow.org