Rep. Rob Chase: LTC tax postponed but not fixed, OIC adopts permanent rule ignoring credit scoring, the latest on emergency powers

Home | About Rob | News & Media | Email Updates | The Ledger | Contact

Dear Friends and Neighbors,

We are about halfway through the legislative session and have reached the first major deadlines. Thursday, Feb. 3, was the policy committee cutoff. Any policy bills that did not make it out of their respective committees are likely “dead” for the year, unless extenuating circumstances arise. Fiscal policy cutoff is on Monday, Feb. 7 (today). The fiscal cutoff does not include bills that may have a fiscal impact on one of the three state budgets.

Much of the first few weeks of session has involved revisiting legislation or policies passed in previous sessions and amending or attempting to fix them. This email update breaks down some of those issues as well as the latest on the Office of Insurance Commissioner moving forward with his banning the use of credit scoring.

Long-term care insurance tax and program

Last week, the governor signed House Bill 1732 into law which delays the insurance tax and program for 18 months. It is now scheduled to begin July 2023 with benefits delayed until July 2026. He also signed House Bill 1733 which will create four new voluntary exemptions from the program.

The bills were fast-tracked through the Legislature, with the governor declaring them “fixed” at his press conference. They are far from fixed, as they disregard the insolvency of the program. You can read what our State Actuary had to say about that here.

Republicans have said it was unfair and flawed public policy. Nearly 63% of voters agreed, so we offered our own solutions. We attempted to bring two other options to the House floor for a vote, but were turned down by the majority party. House Bill 1594 would have been a full repeal, while House Bill 1913 was a repeal and replace measure with a voluntary component to it.

Addressing police reform

There has also been some progress regarding the bad police reform bills passed last year. Two bills I am keeping an eye on, House Bill 1788, related to vehicular pursuits, and House Bill 2037, related to use of force, both made it out of the Public Safety Committee before the cutoff date, but have not come before the full House of Representatives. We will have to wait and see if they go far enough to address the concerns from last year’s legislation.

At the beginning of the year Republicans introduced the Safe Washington Plan, which contains a suite of bills focused on stopping crime, supporting law enforcement, and putting victims first. Unfortunately, most of the bills are not moving through the legislative process. Public safety needs to be a top priority to ensure our communities are safe with the increase in crime.

Insurance commissioner adopts permanent rule ignoring credit scoring

I have heard from many of you throughout the last year regarding Office of the Insurance Commissioner (OIC) adopting an emergency rule banning the use of credit history in calculating insurance premium rates for auto, home and renter insurance. Insurance Commissioner Mike Kreidler first did this on March 22, 2021, ignoring the fact he couldn’t get his legislation to achieve this through the Legislature. He also adopted a subsequent, identical emergency rule in July to cover the expiration of his first emergency rule.

On Oct. 8, 2021, a Thurston County judge overturned the emergency rule stating Insurance Commissioner Kreidler did not have “good cause” to file an emergency.

After losing in the Legislature, and ignoring the insurance industry and court order, on Feb. 1, 2022, Kreidler adopted a permanent rule. Insurers will have to comply by March 4. Why a permanent rule? Emergency rules last for up to 120 days and may not be subsequently extended unless a permanent rule is pursued.

This is another example of state government implementing their own rules and ignoring the Legislature and stakeholders.

The insurance industry estimates the OIC’s rule will raise rates for over one million consumers and be particularly harmful to seniors on fixed incomes.

Senate Bill 5969 could have preempted Kreidler’s ability to act on this issue, but it failed to make it out of the Senate policy committee before the policy committee cutoff date. However, insurer groups are already pursing legal challenges as well.

Here are some articles on this issue.

- Washington insurance commissioner adopts credit scoring ban | AP/OPB

- Commissioner tries again with credit ratings ban in insurance premiums | The Center Square

- Insurer groups sue over Washington state credit scoring ban | The Seattle Times

- Déjà vu: Commissioner bans use of credit to calculate insurance rates, again | KIRO 7

Emergency powers – our efforts to restore balance in government

Washington has been in a “state of emergency” (SOE) for more than 700 days. House Republicans have pushed for emergency powers reform since the pandemic began in 2020. Washington ranks as one of the worst states in the country when it comes to emergency executive powers. Click here for more information.

Last week, in the House of Representatives, more than 5,400 people signed in for the public hearing on House Bill 1772sponsored by Rep. Chris Corry. Most of those signing in were in favor of the bill. The bill would limit the governor’s SOE powers to 60 days, unless extended by the Legislature. It would also limit the governor’s executive orders prohibiting certain actions during a state of emergency to 30 days, unless extended by the Legislature. However, it was not voted out of the policy committee before the cutoff date.

There was a public hearing on Senate Bill 5909, which would allow the Speaker of the House, the House minority leader, and the majority and minority leaders of the Senate to end a SOE if the Legislature is not in session and it has been more than 90 days since the governor’s declaration. It would also allow legislative leaders to end the governor’s prohibitive orders if the Legislature is not in session. While it does not go as far as I would like, it did survive the policy committee cutoff so it is still alive.

For more on our efforts on emergency powers check out this web page.

Why not property tax relief?

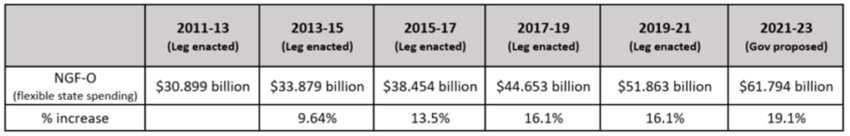

According to the Washington Research Council our state is now looking at a four-year budget surplus of about $11.2 billion, with another $2.2 billion in various reserves, and $1.2 billion in unspent emergency stimulus funds – this despite being in a pandemic, record spending, and our state operating budget almost doubling in the last decade. (see chart below)

With the increase in taxpayer revenues, this is the perfect opportunity to give back to the taxpayers in the form of meaningful property tax relief, or any tax relief for that matter. Our state property taxes are too high. It is contributing to our state’s homelessness situation, as well as our affordable housing crisis, we are seeing in all parts of Washington state. Unfortunately, the majority has not shown much interest in tax relief.

To check out some of our other tax relief proposals, click here.

Follow the Legislature

I have received thousands of emails, messages and phone calls from you on a variety of issues. I urge you to stay engaged. Here are some websites and links that will help you stay engaged this legislative session.

- The Ledger – a legislative news aggregator

- Capitol Buzz – Daily news clips

- How you can be involved in the legislative process

- How to comment on a bill

- Committee Sign-In – Remote Testimony

- NEW! Sign-up for text alerts from Washington State House Republicans | We are trying something new this year. Our text alert system allows you to sign in for text alerts as another way to stay updated on what’s happening in the Legislature.

Please do not hesitate to contact me if you have any questions, comments or concerns on legislative or state issues. Your input and feedback is important to me.

Thank you for allowing me to serve you!

Sincerely,

Rob Chase

State Representative Rob Chase

4th Legislative District

representativerobchase.com

John L. O’Brien Building | P.O. Box 40600 | Olympia, WA 98504-0600

rob.chase@leg.wa.gov

360-786-7984 | Toll-free: (800) 562-6000