Washington State Legislative Update – March 19, 2021

From Representative Rob Chase

March 19, 2021

Dear Friends and Neighbors,

Washington state received some good news last week as Gov. Jay Inslee finally announced a new step in his “Healthy Washington – Roadmap to Recovery” plan. Effective March 22 the entire state will advance to Phase 3.

Despite the declining epidemiological curve, the improving COVID rates and the vaccine rollout Washington state has spent more than a month in Phase 2, and until the governor’s announcement last Thursday, had no idea when or what a next phase would look like.

Republicans in the Legislature had advocated for a Phase 3 plan much sooner. In fact, Republicans introduced their own plan a couple of weeks ago, “Open Safe, Open Now” or House Bill 1553. Our proposal focuses on a local approach as well as getting businesses open to 50% immediately. The governor is ditching his regional approach and going to a county-by-county plan and also opening businesses to 50%. It is good to see the governor using elements of our plan, especially since he dismissed our plan saying – “we’re not following the leadership of Texas.” Our plan is not a Texas-type plan. In fact, it is modeled after what the Democratic governor in Connecticut proposed. Click here for more on that plan. For more on Gov. Inslee’s plan click here.

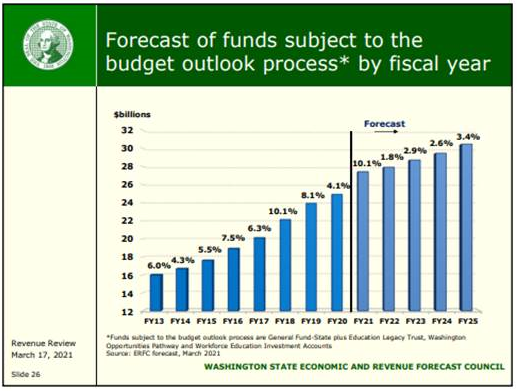

Revenue forecast up $3 billion

Washington state received more good news this week as the Washington State Economic and Revenue Forecast Council released its quarterly revenue forecast. Compared to the November forecast, revenue is projected to increase by $1.34 billion for the current 2019-21 budget cycle, and by $1.95 billion for the 2021-23 budget cycle — a $3.29 billion increase over the four-year outlook.

Last June, it was estimated we could be facing a $9 billion budget deficit this year. However, the last three revenue forecasts have essentially put us back at pre-pandemic revenue levels.

On top of the positive revenue forecast the latest federal stimulus package, the American Rescue Plan Act, is sending Washington state about $7.1 billion in recovery money for local, county, and state governments, in addition to about $3 billion in COVID relief for K-12 schools, higher education, and childcare.

With the $3 billion increase in the revenue forecast and the federal dollars coming in, majority Democrats need to stop looking at new or increased taxes and focus on what type of tax relief we can provide working families.

Despite the dollars coming in the majority party is still talking tax increases. On Monday, in the House Finance Committee we had a hearing on the capital gains income tax, Senate Bill 5096, which passed the Senate by one vote, 25-24, on March 6.

This tax is unnecessary, unreliable given its volatility, and likely unconstitutional. Voters have turned down income tax proposals several times over the years, and the IRS calls it an income tax. Of course, the biggest concern is this would be the first step toward a full-fledged state income tax on our taxpayers.

Majority Democrats have not given a timeline on when the capital gains income tax bill will be voted out of committee and brought to the House floor for a debate and full vote of the chamber.

The Washington State House of Representatives convenes for floor debate, March 1, 2021.

Rep. Chase gives a speech over Zoom in the House chamber during virtual floor debate.

Contentious bills pass House

Last week we finished up two weeks of long days of floor debate. The House sent more than 200 bills to the Senate. While most passed with strong, bipartisan support, Democrats with a 57-41 majority still passed a number of contentious bills despite bipartisan opposition. Bills that would increase how much you pay at the fuel pump, take away tools our law enforcement officers use to de-escalate situations, automatically restore felon voting rights before completed sentences, hurt business, and make it nearly impossible for rental property owners to evict bad tenants.

- House Bill 1091 | Low-carbon fuel standard mandate | Would increase the cost of gas and diesel, by as much as 57 cents and 63 cents a gallon, without generating any new revenue for transportation projects, be bad for businesses and our economy, and offer little benefit to air quality. Passed the House 52-46.

- House Bill 1054 | Police tactics and equipment | Would take away tools police officers rely on to de-escalate situations and avoid the need to use deadly force, and make the job of police officers even more dangerous. Passed the House 54-43.

- House Bill 1310 | Use of force by officers | There are concerns the bill fails to recognize a number of circumstances where force may be required to ensure public safety. Officers should be held to a professional standard (i.e., the “reasonable officer standard”). This bill undercuts the reasonable officer standard established in I-940. Passed the House 55-42.

- House Bill 1078 | Felon voting rights | Would automatically restore felon voting rights before completed sentences, including for those who committed heinous violent and sexual offenses, which would be unfair to many crime victims and their families. Passed the House 57-41.

- House Bill 1097 | Worker protections | This legislation shifts costs to employers. It contains vague standards and would create uncertainty for businesses in a time when they are already struggling and stressed in this difficult economic time. Passed the House 53-44.

- House Bill 1076 | Qui Tam actions | This bill would incentivize attorneys to seek out private citizens to sue the government so they could reap a portion of the financial award. This type of system is ripe for abuse and there is no safeguard to prevent a surge in frivolous lawsuits. This just adds to the many things employers must worry about with changing employment laws and the governor’s proclamation. Passed the House 53-44.

- House Bill 1236 | Rental property rights | This legislation would take away the rights of property owners to determine who they can rent to or when and why they can evict a tenant. Government would be able to dictate what property owners can and cannot do with their property under this legislation. Passed the House 54-44.

Good bills sent to the Senate

It wasn’t all bad, as some good, bipartisan legislation was passed including the legislation I have worked on to eliminate heavy penalties on delinquent property tax payments. Other bills include:

-

- House Bill 1168 would help prevent and fight devastating wildfires by focusing on long-term forest health.

- House Bill 1410 would repeal heavy penalties on delinquent property tax payments, to help those who are struggling to pay their property taxes. Should we get this through the Legislature folks could pay any amount at any time at 9% interest.

- House Bill 1170 would strengthen and build our economy by establishing a goal to double manufacturing jobs and firms over the next 10 years.

- House Bill 1015 would create the Equitable Access to Credit Program within the Department of Commerce to make it easier for small businesses in rural and underserved communities to access lines of credit.

- House Bill 1137 would elevate road maintenance and preservation in transportation planning.

- House Bill 1438 would expand eligibility for the senior and disabled veteran property tax relief program by excluding common medical expenses from calculation of income for purposes of eligibility.

Stay in touch

I appreciate those who have taken the time to contact me this session. Your input and feedback is important to me. There are a lot of high-profile issues still ahead of us to be decided – budgets, transportation packages, capital gains income tax, and much more so please do not hesitate to contact me with any questions, concerns or comments.

Thank you for allowing me to serve you!

Sincerely,

Rob Chase